Canadian Sailings: December 3, 2015 @ 8:32 am

Original Source: http://www.canadiansailings.ca/?p=10739

By Alan M. Field

Starved for new markets to conquer, American exporters and investors are avidly awaiting the imminent end of the fifty-five year-old U.S. trade embargo of Cuba. Given the current abundance of Cuba-focused business conferences, seminars and traveling delegations to the island-nation, Canadians might well be wondering whether the mania for all things Cuban in the U.S. will also provide a golden opportunity for Canadians to leverage their unique ties with Cuba. Or will it, on the contrary, signal the end to that special relationship at precisely the time when the rest of the world has discovered Cuba?

Starved for new markets to conquer, American exporters and investors are avidly awaiting the imminent end of the fifty-five year-old U.S. trade embargo of Cuba. Given the current abundance of Cuba-focused business conferences, seminars and traveling delegations to the island-nation, Canadians might well be wondering whether the mania for all things Cuban in the U.S. will also provide a golden opportunity for Canadians to leverage their unique ties with Cuba. Or will it, on the contrary, signal the end to that special relationship at precisely the time when the rest of the world has discovered Cuba?

Trade relations between Canada and Cuba originated during the era when vessels from the Atlantic provinces of Canada traded codfish and beer in Cuba for that country’s rum and sugar. “Canada has been a major trading partner with Cuba dating back to the 1800s,” notes Arch Ritter, an economist at Carleton University, who has written extensively about Cuba’s economic history. “Our ties have been longstanding, and we have never cut trade ties with Cuba.”

Over the past few decades, trade ties between the two countries have grown significantly, but remain modest compared with the volumes that could follow the end of the U.S. trade embargo, and the re-opening of U.S. foreign investment in Cuba. In August 2015, bilateral trade between Canada and Cuba amounted to $100.7 million [Canadian dollars], compared with just $58.4 million in August 2000, and only $33 million in August 1990. From 2000 to 2008, the value of Canadian exports to Canada grew at an annual rate of 11 per cent, while imports from Cuba grew at a rate of 10 per cent. Ontario is the largest provincial exporter to Cuba, followed by Quebec. Manitoba and British Columbia have been the fastest-growing provincial exporters in recent years, according to a report by the Library of Parliament in Ottawa.

Mark Entwistle, a former Canadian ambassador to Cuba (1993-1997) and a founding partner of Acasta Capital, a Toronto-based investment firm, recalls the long decades when Canadian diplomats were the only representatives of any Western democracy at Havana cocktail parties, “Among Western democracies, Canada is the only one that never broke relations with Cuba even once,” Entwistle added.

Canadians imported Cuban sugar, rum and cigars, while exporting a lot of machinery and equipment that “Cuba could no longer get from the United States,” explained Ritter. During the 1990s, when the Soviet Union stopped subsidizing Cuba, the island’s economy “really deteriorated,” added Ritter, “and ties with Canada really intensified. Cuba decided it needed tourism, so it promoted that sector. We became the big tourist country for Cuba, and people said, ‘Cuba’s best friend is the Canadian winter.’” Nowadays, Cuba ranks as the third-most popular overseas destination for Canadians – after only the United States and Mexico – while Canada is Cuba’s largest source of foreign tourists; over one million Canadians visit each year, or more than 40 per cent of all foreign visitors to Cuba.

Burned by Cuba’s ups and downs

During the 1990s, Cuba opened up its economy “a little bit” to foreign enterprises, added Ritter. The mining sector became the focal point of great activity as “a lot of Canadian companies went down there to see if they could prove any commercially viable mineral resources. They all came back empty-handed after a few years, but they were really optimistic because Russia had done the surveying. The Canadian companies thought they just needed to do the work on the ground,” Ritter went on. It turned out that things weren’t so simple.

Other Canadian enterprises went there, but few were successful, noted Ritter. “There were Canadian hotels that pulled out. There was interest in time-share condominiums, and the Cubans changed their mind on that, so that did not go forward. More recently, in the late 2000s, a number of Canadian enterprises made arrangements to invest fairly massive amounts of money in golf courses and related resorts. But those have been put back on the shelf; nothing has happened. I think the Cubans changed their minds [about that],” lamented Ritter. Overall, “The rules have been so fuzzy that every decision is sort of a customized ad hoc decision. The rules of the game come down to case by case decisions by Cubans.”

The only major Canadian firm to enjoy enduring success was Toronto-based Sherritt International, a resource company with interests in nickel and cobalt mining, oil and gas exploration and production, and electricity generation. Ritter said that Sherritt has been “wildly successful for Cuba and for Sherritt.” However, Sherritt’s huge success has not been repeated by other Canadian firms in the Cuban energy sector. In 2009, Pebercan, Inc., a Montreal-based oil producer, was notified by the Cuban government that it would scrap its production-sharing contract with the Canadian firm. That contract, signed by Pebercan and the Cuban government in 1993, had been scheduled to expire in 2018. Neither party to the contract ever announced any reason for the government’s decision to cancel it.

Goodwill is like an isotope that is trickling down

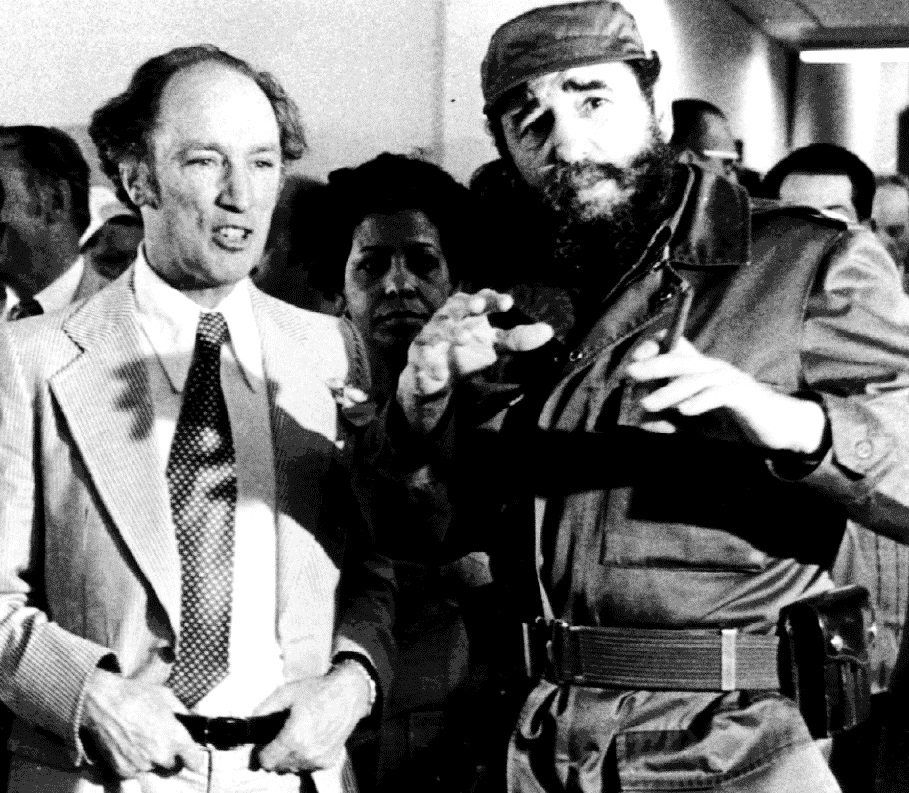

George Petrolekas, a former Marketing Director of a Canadian telecom, who has traveled on business in Cuba, said that former Prime Minister Stephen Harper’s conservative government “has been less receptive to links with Cuba than previous governments, which were Liberal.” During the late 1990s, “The most receptive Canadian governments were probably those of Pierre Elliott Trudeau, and Jean Chretien, to a lesser extent.” Petrolekas said that Harper has been “far harder on Cuba” than other Prime Ministers, such as Brian Mulroney.

Entwistle argues that even under left-leaning Canadian Prime Ministers, Canada has not taken full advantage of existing opportunities to promote Canadian corporate exporters and investors. “Truth be told, no Canadian government of any political stripe has exercised the full weight of instruments available to it for things like trade promotion.” Entwistle believes that Export Development Canada (EDC), which provides Canadian exporters with financing, has “never been overly active in Cuba, in terms of supporting Canadian business. Canadian business has done its own thing in Cuba, regardless of the government.”

Nor have there been a sufficient number of high-level visitors from Ottawa, waving the Canadian flag to drum up new business. Entwistle said, “There have been some political visits; Pierre Trudeau came in 1976; he was the first NATO-member state leader to do so. [Jean] Chretien also went—partly because Trudeau went.” Would it help if the next Canadian Prime Minister paid such a visit? “Hypothetically, if you had a Liberal government, there would be some explosion of activity on the part of the government of Canada in pursuing its relationship; but I think it will probably be business as usual. No government does tremendous damage to the relationship because it does tend to have its own rhythm, and you have this huge number of Canadians who go as tourists; well over a million a year.”

The sluggishness of the relationship defies the rosy expectations of earlier generations of Canadian business leaders. “At least one generation of Canadians in public life always believed that Canada had a special relationship with Cuba,” Entwistle continued. There was an assumption that “this relationship would translate into some sort of privileged access; an ability to leverage the relationship; to acquire things or positions – decisions from the government of Cuba that we want to see. The whole Canadian foreign policy establishment believed that for a long time.”

This presumption of privileged access has turned out to be false, said Entwistle. “While Cubans are very respectful of Canada and they value the relationship very much, we don’t have any special access or privileges in Cuba. We’re in competition with everyone else; you have to earn your keep; earn your way.” Ritter agreed that “Canadians had said for so long that we had built up a lot of goodwill in Cuba – and that it would pay off in the future.” Not true. And yet as early as 2002, when President George W. Bush enabled U.S. exports of pharmaceuticals and foodstuffs to Cuba, Canadians were disappointed with the reaction of their Cuban customers. As soon as lower-priced food became available from the United States, the Cubans switched to it, despite the ongoing U.S. trade embargo in other product sectors. Canada’s business activity in Cuba has been further hampered by the Helms-Burton Act of 1996, which penalizes all foreign companies that do business in Cuba by preventing them from doing business legally in the United States.

Reviving the special relationship

Overall, argued Entwistle, “Canada has an asset that has been created by the 70 years of unbroken ties, but it is being squandered. The goodwill of the relationship on which Canada dined out for a long time is like an isotope with a half-life. It is trickling down and has not been replenished sufficiently. ”

What measures would Entwistle take with respect to Cuba if he were Prime Minister of Canada? First of all, “I would increase the number of political visits at the ministerial level. In a country like Cuba, those kinds of visits, led by [cabinet level] ministers have real value. They signify the importance of the relationship; they provide entrée and access to senior decision makers in the Cuban government. [Canada’s] global competitors have been very active in this. “

In the wake of the normalization of U.S. diplomatic ties with Cuba, senior ministers from several major trading nations have descended on Havana in recent months, accompanied by senior executives from major corporations headquartered in those countries. For example, the President of France brought some 70 French companies; the Spanish prime minister, almost the same number; and likewise from Mexico and elsewhere. Meanwhile, Canadian leadership have undertaken no such large-scale missions in Cuba, of late, perhaps out of a sense that such missions are not necessary, given the decades of mutual goodwill. Despite Canada’s world-famous expertise in telecommunications, Orange S.A., the French telecom company, signed a deal to assist in the development of Cuba’s (government monopoly) telephone network in July 2014. “It’s the kind of deal we could have done, but we just didn’t bother to go there and do it,” Entwistle said.

What role can Canadians play in the Cuba of the future?

The Cuban government has outlined the important role to be played by foreign investment flows in the sustainable development of the country. In 2014, Cuba’s minister for foreign trade and investment said on state TV that the country needs a sufficient volume of foreign capital in order to achieve its economic growth target of 7 per cent a year. Its goal is attract $2 billion to $2.5 billion in foreign direct investments each year, notes Philip Peters, President of the Cuba Research Center. Peters says that target is “pretty ambitious,” given the fact during the entire 1990s, Cuba managed to attract a total of only $4 billion to $5 billion in inward foreign investment.

What will that expansion mean for Canadians? Economist Ritter believes that there are two ways of looking at the ultimate impact of the arrival of so many Americans on Cuban soil. One of those ways is positive; the other is negative. “There will be two kinds of effect. One will be a squeezing out effect in some areas. But there isn’t that much to be squeezed out, so I don’t think we lose so much,” added Ritter, in terms of current Canadian market share in Cuba; given the limited range of Canadian success stories in the world of industry.

When it comes to the tourism sector, there is a divergence of views. Ritter said that “a second squeezing-out effect will take place in the tourism industry, as the tsunami of tourists arrives from the United States. They could squeeze out a lot of Canadians,” given the fact that the typical Canadian tourist in Cuba has a more modest budget than his or her counterpart from the United States. Other analysts, including Entwistle, believe that there will be plenty of room in Cuba – the largest island in the Caribbean – for tourists traveling on all kinds of budgets, from modest cottages suitable for hippies to jet-set plutocrats. The key is to build the infrastructure that supports that expansion for all segments of the market. That’s an area where Canada can fill the gap with additional capital.

A range of enticing new opportunities may open for Canadians to export to Cuba and invest in that country, in partnership with Americans and other newcomers to the island. If the newly pragmatic Cuban government is as transparent as optimists say it will be, Canadians will be making more money in Cuba even if they wind up owning a smaller share of a much larger Cuban pie. Some Canadian companies could play a key role as intermediaries; consultants who advise and partner with U.S. companies that don’t already know Cuba the way a handful of Canadians know it. Apart from their greater familiarity with Cuba, argues Petrolekas, Canadians have this advantage: “There is not a sense that we [Canadians] are there to exploit Cubans. They like us from that standpoint. There are enough companies that operate cross-border between the U.S. and Canada, and we can certainly assist in that.”

How Canadians can improve their chances of success in Cuba

What steps can Canadians take to improve their chances of success? Entwistle notes that “the trick to improving your chances in Cuba is to align [your initiatives] with the Cuban government’s priorities, which have more to do with the real, basic economy than with the bells and whistles of advanced high-technology [economies]. The Cubans are remarkably smart. They have a home-grown leadership that is very serious, very earnest, analytical and methodical.”

Entwistle advises Canadians to study the priorities outlined in the 2014 foreign investment law, which target agricultural development; basic manufacturing, including such substitutes for imports as glass bottles and aluminum cans; and renewable energy, including wind power. In the past, Cuba has benefitted from low-priced, subsidized energy imports from Venezuela, but that country has been suffering economic and political disarray. That makes it riskier than ever for Cuba to depend on Venezuela for low-priced energy imports in the future, industry analysts agree. Another Cuban priority is biotechnology: Close to a dozen biotech institutes have been built in Cuba; meanwhile, Novartis and AstraZeneca – two European pharma companies – have a significant presence in the country.

Tourism remains particularly enticing. Cuba is looking for foreign partners to expand its hotel sector infrastructure quickly, in preparation for the huge flood of American tourists. Canadians may also be able to leverage growing demand for ‘medical tourism,’ which could develop into a huge source of revenue for the island, and for joint-venture partners from capitalist countries. World-famous for its quality, the Cuban medical system is offering medical services for Canadians via Health Services International (Servimed), an agency officially recognized by Cuba’s national medical system. Demand for such services is expected to grow, as well, in the United States, once full trade relations are normalized.

In conclusion, cautions Entwistle, “Cuba is not an economy that is for profiteering in any way; or for get-rich schemes, or getting in and out. This is a long-haul, strategic, patient market that is evolving in front of our eyes; at a very Cuban pace. You need a longer term vision. The companies that have been successful in Cuba have that long term vision, which allows them to ride the fluctuations of the daily ups and downs of doing the actual business. My advice is do less pitching and more listening. And if your business is in areas that are Cuba’s priorities, then you have a real good chance.” If he’s right, Canadians’ cultural aversion to flashy, get-rich-quick salesmanship could work out to their advanta

![TORONTO, ONTARIO: JANUARY 29, 2015--FOREIGN--Former Canadian ambassador to Cuba Mark Entwistle spoke with Financial Post reporter Peter Kuitenbrouwer at Toronto's Nespresso Cafe, Thursday January 29, 2015. Entwistle is now active in advising Canadian companies who may wish to invest in Cuba. [Peter J. Thompson/National Post] [For Financial Post story by Peter Kuitenbrouwer/Financial Post] //NATIONAL POST STAFF PHOTO fp013115-pes-cuba](https://thecubaneconomy.com/wp-content/uploads/2015/02/sent_pjt-markentwistle-5.jpg)