By Pedro Monreal in elestadocomotal on November 25, 2020

Original Article: SUGERENCIA PARA UNA NORMATIVA DE PYMES EN CUBA

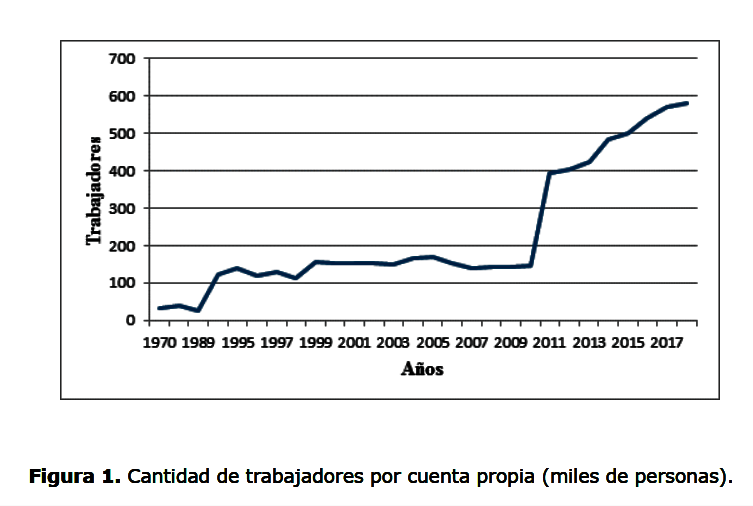

La legalización de las pequeñas y medianas empresas privadas (PYMES) es, por amplio margen, el “eslabón perdido” del programa oficial de cambios económicos en Cuba. Mencionada, pero no implementada ni siquiera a nivel de preparación de condiciones, al menos públicamente, y “empaquetada” de una manera confusa con algo a lo que se le denominan PYMES estatales, llama la atención la parsimonia con la que se aborda uno de los temas respecto a los que se dispone de mayor evidencia internacional acerca de su potencial efecto positivo en el empleo y en la productividad nacional.

He estimado que el establecimiento de PYMES en Cuba pudiera aumentar el Producto Interno Bruto (PIB) entre 1,5 y 1,7%. (1)

La dilación de la medida introduce un problema de secuencia en el programa económico oficial pues, al aplicarse ahora el llamado “ordenamiento” (una mezcla de hiper-devaluación, alza de precios y salarios, y eliminación de subsidios) se asume un riesgo inflacionario debido a la carencia de una capacidad de respuesta de oferta que pudiera haberse reducido si se hubiesen legalizado primero las PYMES.

Después del anuncio del “paquete económico” del verano, publiqué dos propuestas sobre medidas muy relacionadas. Primero, presenté en agosto una propuesta para el establecimiento de las PYMES, y luego, a principios de octubre, publiqué una propuesta para reformar el trabajo por cuenta propia (TCP) mediante la adopción de un esquema de trabajadores “autónomos”. (2)

A nivel de esos dos temas, el marco de referencia más amplio era la legalización de las PYMES. De hecho, la primera fase de la “travesía” hacia las PYMES consistía precisamente en el establecimiento de un marco normativo del trabajo “autónomo”.

El problema es que, aunque sobre la reforma del TCP se hablado oficialmente de tal manera que parecería ser una acción de mayor inmediatez en comparación con las PYMES, en realidad muy poco se ha hecho en la práctica. Considero que se presta gran atención a la transformación del TCP en sí mismo, sin que frecuentemente se conecte ese posible cambio con otras transformaciones futuras. (3)

Retomo ahora aquellas propuestas, pero con las modificaciones que considero que habría que priorizar en las circunstancias actuales.

¿Por qué retomo las propuestas, y por qué las retomo de manera modificada?

No parece realista asumir que se legalicen las PYMES en el plazo inmediato, pero no debería descartarse que un desbalance macroeconómico eventualmente derivado del “ordenamiento” pudiese tener el efecto de conducir a una modificación de las secuencias del resto del programa económico.

El establecimiento de las PYMES representa la mayor reserva de productividad a corto plazo y la fuente más expedita de creación de empleo neto del país. Es también la fórmula menos costosa -para las finanzas públicas- para lograr esos dos objetivos.

Tomo nota de los argumentos políticos que parecen obstaculizar la legalización de las PYMES, pero llamo la atención sobre los costos políticos de una eventual combinación de estancamiento con inflación debido a la falta de acción en un componente de la economía como las PYMES. (4)

Las PYMES pudieran aliviar eventuales tensiones sociales porque pudieran crear rápidamente empleos e ingresos, así como favorecen el incremento de la productividad, tanto directamente en las PYMES como al facilitar la reforma de la empresa estatal.

En mi modesta apreciación, lo que ha cambiado recientemente es la urgencia sobre la necesidad de disponer de un “plan B” porque considero que el “ordenamiento” contiene fisuras conceptuales y parece haber adoptado varios supuestos polémicos. He comentado anteriormente el tema del “ordenamiento”. (5)

Aclaraciones sobre una nueva normativa de PYMES.

Debido al tiempo que se ha perdido con la reforma del TCP, la propuesta revisada que se presenta a continuación ya no considera esa reforma del TCP como la primera fase de un proceso de establecimiento progresivo de las PYMES.

El enfoque ahora es diferente: se establecen las PYMES como un proceso sin fases en las que determinadas acciones que antes estaban separadas en el tiempo se realizarían ahora de manera simultánea.

Conviene recalcar que la propuesta se enfoca en el establecimiento de las PYMES, específicamente su legalización y puesta en operación. Es decir, posteriormente deberían adoptarse otras medidas adicionales respecto a las PYMES, especialmente en cuanto a las acciones para apoyarlas, pero lo urgente es ponerlas ahora en funcionamiento.

He expresado en un texto anterior que después de lograr la legalización de las PYMES habría que continuar desarrollando el marco normativo para apoyarlas estatalmente porque las PYMES son entidades relativamente frágiles que cumplen funciones importantes en términos de empleo nacional y de “conexión” del tejido económico. (6)

Es también importante aclarar que me limito a identificar los componentes de la normativa de PYMES, desde una perspectiva económica y por tanto no he considerado los componentes jurídicos, los cuales son muy importantes y obviamente habría que precisarlos con las contribuciones de juristas, para poder desarrollar una norma integral para las PYMES.

Aunque no tengo capacidad para pronunciarme sobre los detalles legales, asumo que el establecimiento de ese marco normativo no necesitaría una ley. Quizás sería suficiente un “Acuerdo” del Consejo de Ministros para implementar algo que ya está políticamente aprobado en el documento de la “Conceptualización”. Se complementaría con resoluciones de los ministerios relevantes.

Quince puntos para una normativa de PYMES en Cuba

Desde el punto de vista de sus componentes económicos una normativa para el rápido establecimiento “de PYMES en Cuba debería incluir, al menos, los siguientes aspectos:

- DISPOSICIONES GENERALES

- Alcance de la regulación: Principios, contenidos y descripción general del procedimiento para el establecimiento de las microempresas y de las pequeñas y medianas empresas privadas y de las responsabilidades de los organismos, organizaciones e individuos involucrados en el proceso de su establecimiento.

- Sujetos de aplicación:a) Empresas privadas que operan de conformidad con la ley y que cumplen los criterios para identificar las microempresas y las pequeñas y medianas empresas.

- b) Entidades estatales que participan en el proceso de establecimiento de las microempresas y de las pequeñas y medianas empresas.

- Interpretación de términos: Incluye definiciones de “microempresa” y de “pequeña y mediana empresa”, como categorías distintas. Se precisan otros términos como “eslabonamientos” y las diferentes figuras del “Código de comercio de Cuba” que fuesen relevantes (“registro mercantil”, “comerciantes particulares”, “sociedades”, etc.)

- Criterios para la identificación de las pequeñas y medianas empresas: son pequeñas y medianas empresas aquellas con un volumen anual de ventas comprendido en un rango desde 10 veces hasta 1000 veces el ingreso nacional per cápita. (7)

La categoría de pequeñas y medianas empresas (PYMES) no distingue entre las pequeñas y las medianas empresas. (8)

Las microempresas son aquellas con un volumen anual de ventas inferior a 10 veces el ingreso nacional per cápita. Las microempresas no se incluyen en la categoría de PYMES.

- REGISTRO DE EMPRESAS

- Tipos de registro: Incluye dos registros simultáneos:

- Inscripción en el Registro Mercantil en alguna de las categorías que se habiliten al efecto.

- Inscripción en registros separados de microempresas o de PYMES, según corresponda (supervisados por el Ministerio de Economía y Planificación).

- Definición de las opciones de registro:

- Procedimiento “express” para las personas naturales que ya cuentan con una licencia de trabajo por cuenta propia (TCP) y que desean registrar su actividad como persona jurídica (empresario unipersonal o sociedad) en la misma “clase” de actividad compatible con la labor para la que se emitió la licencia de TCP. (9)

- Procedimiento “regular” para las personas naturales que no cuentan con una licencia de TCP o que teniendo la licencia TCP desean modificar la “clase” de actividad.

En el caso del registro “express” solamente se verifican los documentos actuales de la licencia TCP y se formaliza el registro doble (en Registro Mercantil y Registro de microempresas/PYMES) mediante una única declaración jurada.

Nota: los poseedores de licencias de TCP que no deseen registrar su actividad como microempresas o PYMES continuarían ejerciendo el TCP, cuya regulación no es objeto de esta normativa.

- Establecimiento de una ventanilla única: Funciona para el registro de las microempresas y PYMES en cada una de las dos opciones (“express” y “regular”) e incluye el registro simultáneo como sociedad mercantil y como PYME.

III. APOYO AL ESTABLECIMIENTO DE LAS MICROEMPRESAS Y DE LAS PEQUEÑAS Y MEDIANAS EMPRESAS

- Apoyo general a microempresas y PYMES:

- Asesoramiento y orientación de manera gratuita sobre expedientes y procedimientos para el establecimiento de empresas.

- Exención o reducción de los gastos por asistir a cursos de formación profesional financiados por el presupuesto.

9.Apoyo a microempresas:

- Exención del pago de la inscripción simultánea en el Registro Mercantil y en el Registro de Microempresas.

- Exención del pago del impuesto por la utilización de la fuerza de trabajo.

- Pago reducido de la contribución de la empresa a la seguridad social de los empleados durante los tres primeros años.

- Pago reducido del impuesto sobre la ganancia aplicado a las microempresas durante el primer año.

- Las microempresas podrán aplicar procedimientos administrativos y regímenes contables simples relacionados con los impuestos de conformidad con las normas fiscales y contables.

- Apoyo a PYMES establecidas a partir de licencias previas de TCP (procedimiento “express”):

- Exención del pago de la inscripción simultánea en el Registro Mercantil y en el Registro de Microempresas.

- Exención del pago del impuesto por la utilización de la fuerza de trabajo.

- Pago reducido del impuesto sobre la ganancia aplicado a las PYMES durante el primer año.

- Apoyo a PYMES establecidas mediante el procedimiento “regular”:

- Exención del pago de la inscripción simultánea en el Registro Mercantil y en el Registro de Microempresas.

- Exención del pago del impuesto por la utilización de la fuerza de trabajo.

- Apoyo a PYMES agro-alimentarias: Las pequeñas y medianas empresas con actividades que forman parte de cadenas de valor en el ámbito de la producción o la transformación de alimentos se beneficiarían de:

- Formación de los trabajadores –mediante financiamiento estatal- en tecnología y técnicas de producción, asesoramiento en normas y reglamentos técnicos, metrología y calidad para el desarrollo de productos y servicios orientados a eslabonamientos industriales y cadenas de valor.

- Proporcionar información actualizada y sin costo sobre la demanda y condiciones de encadenamientos.

- Apoyo estatal para el desarrollo de marcas y mercados en expansión para productos y servicios que tributan a cadenas de valor.

- Apoyo técnico del Estado a PYMES que participan en polos agro-alimentarios, en cuanto a la producción, inspección, evaluación y certificación de la calidad de sus productos y servicios.

- Subvenciones a los tipos de interés, a través de entidades de crédito, para los préstamos a PYMES que participen en polos agro-alimentarios.

- Apoyo a PYMES tecnológicas:

- Apoyo estatal en la aplicación y transferencia de tecnología, uso de equipos en establecimientos estatales, participación en esquemas de transferencia de resultados de investigación de universidades e instituciones de investigación, orientación sobre la experimentación y desarrollo de nuevos productos, servicios y modelos empresariales.

- Apoyo legal estatal en temas de propiedad intelectual.

- Capacitación de trabajadores de las PYMES en la producción y desarrollo de productos, atracción de inversiones, asesoramiento en materia de propiedad intelectual, ejecución de los procedimientos para las normas y reglamentos técnicos, metrológicos y de calidad.

- Tarifas reducidas de comunicación y de acceso a internet.

- Apoyo estatal a la información, comunicación, promoción comercial, y conexión con redes de entidades innovadoras nacionales y extranjeras.

- Subvenciones a los tipos de interés, a través de entidades de crédito, para los préstamos a las PYMES innovadoras que participen en programas estatales de ciencia y técnica.

IV DISPOSICIONES PARA LA APLICACIÓN

- Enmiendas y suplementos a leyes y normas vigentes: Se identifican las normas legales vigentes que se verían modificadas por la adopción de la presente norma.

15 Entrada en efecto: Definición de la fecha de comienzo de aplicación de la nueva norma para las microempresas y PYMES privadas.

Resumiendo,

La tardanza con la legalización de las PYMES privadas ha representado un error en la secuencia de las transformaciones económicas que necesita Cuba. No debería descartarse que el llamado “ordenamiento” produjese desequilibrios macroeconómicos, especialmente de tipo inflacionario, que hicieran necesario fomentar una capacidad de respuesta rápida de oferta mediante el establecimiento de PYMES privadas, lo que a la vez podría crear condiciones favorables para otras medidas, principalmente la reforma de la empresa estatal. Anticiparse a ese eventual escenario implicaría disponer de un “plan B” para la legalización expedita de las PYMES privadas en Cuba.

Notas

1 “El establecimiento de PYMES en Cuba pudiera aumentar el Producto Interno Bruto entre 1,5 y 1,7% ”, El Estado como tal, 28 de abril de 2020 https://elestadocomotal.com/2020/04/28/el-establecimiento-de-pymes-en-cuba-pudiera-aumentar-el-producto-interno-bruto-entre-15-y-17/

2 “Travesía en tres fases hacia las PYMES en Cuba: una propuesta para “destrabar” fuerzas productivas”, El Estado como tal, 19 de agosto de 2020 https://elestadocomotal.com/2020/08/19/travesia-en-tres-fases-hacia-las-pymes-en-cuba-una-propuesta-para-destrabar-fuerzas-productivas/ , y “Hacia un esquema de “autónomos”: propuesta para reformar el trabajo por cuenta propia en Cuba”, El Estado como tal, 5 de octubre de 2020 https://elestadocomotal.com/2020/10/05/hacia-un-esquema-de-autonomos-propuesta-para-reformar-el-trabajo-por-cuenta-propia-en-cuba/

3 “Travesía en tres fases hacia las PYMES en Cuba: una propuesta para “destrabar” fuerzas productivas”. Op. Cit.

4 “Las PYMES y la reforma del modelo cubano: ayúdame que yo te ayudaré”, El Estado como tal, 23 de julio de 2020 https://elestadocomotal.com/2020/07/23/las-pymes-y-la-reforma-del-modelo-cubano-ayudame-que-yo-te-ayudare/

5 “Ordenamiento, salarios y precios en Cuba: notas sobre el riesgo de inflación”, El Estado como tal, 5 de octubre de 2020, 17 de noviembre de 2020 https://elestadocomotal.com/2020/11/17/ordenamiento-salarios-y-precios-en-cuba-notas-sobre-el-riesgo-de-inflacion/

6 “Travesía en tres fases hacia las PYMES en Cuba: una propuesta para “destrabar” fuerzas productivas”. Op. Cit.

7 En el caso de Cuba, tomando el PIB per cápita de aproximadamente 8900 CUP anuales (370 USD aplicando una tasa de 24:1), las PYMES serían entidades con ventas anuales en el rango de 3700 a 371000 USD.

8 Hay especialistas que recomiendan establecer una categoría de PYMES que considere exclusivamente las pequeñas y medianas empresas (sin establecer diferencias entre ambas), y que permita diferenciarlas de las micro empresas y de las grandes empresas. Es un criterio que se apoya en la observación empírica de que en la práctica las microempresas raramente se convierten en pequeñas y medianas empresas, por lo que se trata de dos niveles de escala complementarias, pero con poca dinámica de transformación entre esas dos agrupaciones de entidades. Por otra parte, se considera que a nivel de las pequeñas y medianas empresas existe una marcada intención de transitar hacia una escala mayor y que, aunque las probabilidades de materialización no son altas para muchas de esas empresas, es un fenómeno observable. Ver, Tom Gibson, “Defining SMEs: A Less Imperfect Way of Defining Small and Medium Enterprises in Developing Countries”, Brookings Global Economy and Development, September 2008.

9 Se refiere a la “clase”, identificada por cuatro dígitos en el Clasificador Nacional de Actividades Económicas (CNAE).