Original Article: INFLATION IN CUBA

Omar Everleny Perez Villanueva (El Toque)

HAVANA TIMES – Figures published by the Cuban Government place inflation at 77%. Calculations by other economists have set it much higher. The complexity of giving a number proves just how complicated the Cuban economy is, where different markets coexist, alongside each other yet completely divided, each of them with their own prices and currencies.

If we stick to the basic concept of “inflation”, which is the widespread increase of average prices in a country over a certain period of time, then we need to calculate it bearing in mind a basic basket of products and services essential to keep an average household going.

There is a basic basket that is available to every household every month, and it is no longer subsidized today. However, it isn’t enough to cover the monthly needs of a family. It’s estimated that this basket only lasts approximately ten days, on average.

Families must turn to sketchy markets in either Cuban pesos or the USD priced products with foreign currency (MLC) cards to make up for the rest of the month, or to free supply or demand markets, both agricultural and industrial, or to the illicit market even to satisfy certain needs. Prices of food and other products have shot up by 500% on these markets.

This high rate of inflation distorts market signals and generates inefficiency, while driving up Cubans’ cost of living.

Causes and prediction of Cuba’s informal exchange rate in 2021

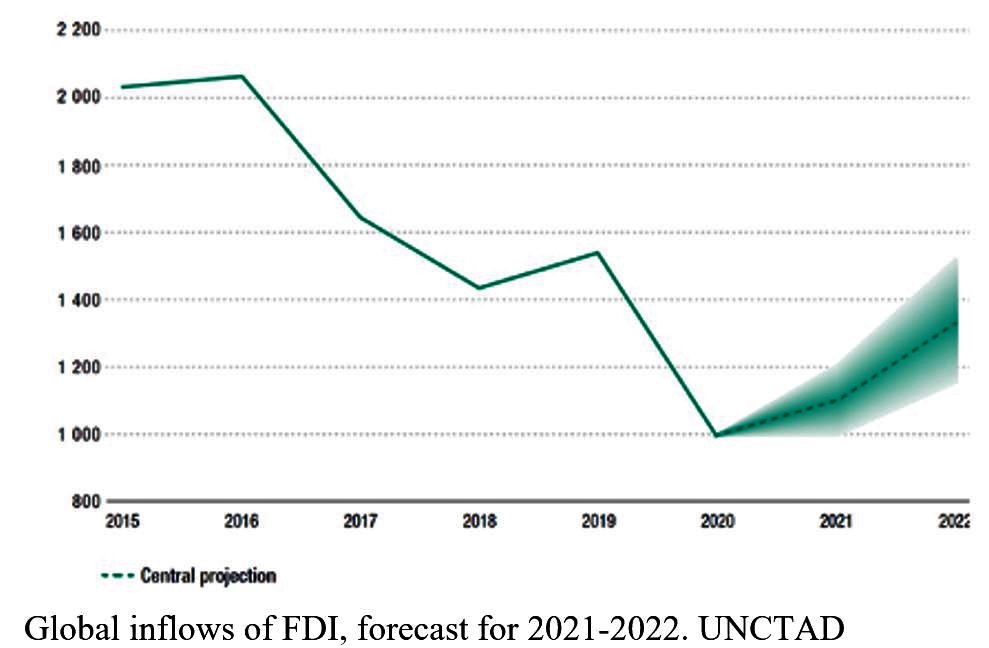

Less supply and more demand for foreign currency has prompted a tendency for the devaluation of the Cuban peso on the illicit market, almost all year round.

Cuba’s inflation crisis today isn’t news though. The country experienced the Special Period, which was the result of the disappearance of the Socialist market, when the national GDP dropped by over 35% in the early nineties, at the same time there was a setback in exports, going hand-in-hand with shortages of monetary resources because of the cancelation of credit that Cuba received from Socialist economies. However, times are even more testing today.

We know that prices shot up in the early nineties because of shortages of products and wages remaining the same, even though companies were paralyzed. This is why the population had 73% of liquidity compared to the GDP. This liquidity dropped when Cuban began to reap the benefits of its economic reform. Liquidity stood at 58.9% in 2018.

During the Special Period, the exchange rate for the dollar was 160 Cuban pesos given the non-existence of a formal market – very few people were receiving or earning in dollars. This currency was also needed to buy at new stores created for this end: there were products being sold only in dollars. With the creation of CADECAs (bureaus de change, the exchange rate stabilized at 24 Cuban pesos: 1 dollar, despite fluctuations. The Government decided to set this fixed exchange rate.

The inflation domino

No matter how much they say inflation can’t exist, it doesn’t answer to bureaucracy, leaders or their followers. The only way to control it is to apply appropriate measures at the right time and place; which takes us back to science, historic experience, studies and analysis, never a political agenda.

Currency Reform (January 2021) brought with it a significant pay rise. Quite a considerable group of workers are receiving higher wages via profit sharing at their institutions; although, in most cases, public sector workers’ monthly wages have less purchasing power today than they did in previous years, as a result of prices skyrocketing.

The basic basket anticipated by the Reforms Process was to be sold for 1528 CUP. This calculation must have been based on the official exchange rate of 1 USD : 24 CUP. However, it was recently reported that this basket shot up to 3250 CUP in Havana and to 3057 CUP in the eastern provinces, while average wages in the country only stand at 3838 CUP. Our friend Pedro Monreal recently said that the cost of the basic basket represented 46.6% of wages in 2019, but according to Cuban authorities, it now represented almost 85% in 2021 and in 2022, this figure will surely continue to grow.

While higher wages or incentives given to a part of the population is socially just, it implies more money in the population’s hands, without this returning to the State as revenue in sales or taxes, because there is very little supply on the market and services running.

The only way to calm down current inflation rates is by producing more. Solutions have been contemplated and the Government has announced a national plan. However, the only thing we’re seeing up until now is their insistence on getting rid of red tape that grinds production to a halt, without seeing any results. While they continue to bet on gradual results from their decisions, the economy will continue to roll backwards.

The following are possible actions that could be taken, but they aren’t the only ones:

- Getting rid of red tape and decisions that come from “superior bodies” to guide state-led companies. The Government keeps saying that they need to decentralize, but results in companies’ production aren’t being seen because they don’t have any real autonomy.

- Get rid of appeals to “make an effort”, “sacrifice” to increase production and substitute this with concepts such as “benefits” and “profits” and others that can be expressed in concrete, measurable statistics, and not aspirations belonging to the metaphysical universe.

- Allowing MSMEs to import without state intermediaries.

- Allowing private owners or foreign companies to invest in the retail market, getting rid of the State’s monopoly on retail stores; that is to say, go from direct control of commercial activity to indirect control via taxes and other control instruments.

- Proposing a more encouraging official exchange rate for MSMEs and other private figures, so they don’t have to turn to the informal market to buy MLC, which the State then demands they purchase their supplies in.

- Encourage business owners to sell in CUP, giving tax breaks to those who sell in this currency.

If only the reforms economists have been proposing for decades are finally set into motion. However, if they continue to disregard them, decision-makers should remember that there is a menu of options still, even in these circumstances, and despite some options on this menu clashing with firmly rooted political and ideological beliefs among the leadership circle.

The Reforms Process and foreign situation with foreign currency is leading to society’s reduced purchasing power, with the corresponding nuisance that this goes hand-in-hand with from a political standpoint. The population is questioning political decision-makers and their questions are growing every day that inflation grows. On the whole, economists point out two reasons for the downfall of a government: high inflation and high unemployment rates.

Inflation has already reached Cuba, and it needs to be reduced. But this implies bold decisions and the courage to break with dogmas. Clearly, will power and appeals won’t fix this problem. These are economic problems that can only be overcome with economic solutions. Cubans emigrating because they’ve lost hope shouldn’t be the solution. The number of people emigrating has shot up exponentially in January 2022 alone, even with the travel restrictions that exist today and the need for foreign currency to go ahead with this decision.