BY WILLIAM M. LEOGRANDE | NOVEMBER 9, 2017

Original Article: SANCTIONS MISS THEIR MARK

REGULATIONS ON TRAVEL AND TRADE WILL LIKELY HAVE LITTLE IMPACT ON CUBA’S GOVERNMENT, HURTING ORDINARY CUBANS INSTEAD.

After two years of restored diplomatic ties, new U.S. regulations on Cuba are bringing back a thicket of travel, financial and trade restrictions – and a tougher stance toward the island. The goal of these restrictions, according to U.S. President Donald Trump, is to starve the Cuban government of money from travel, remittances and commercial ties. But the real victims of the new sanctions will be U.S. residents whose right to travel is curtailed, Cuban families who depend on remittances to survive, the struggling Cuban private sector, and U.S. businesses that will face an even greater disadvantage competing with Asian and European firms.

The regulations issued by the Treasury and Commerce Departments on Nov. 8 re-impose significant limits on educational travel to Cuba that former President Barack Obama relaxed. They also redefine “prohibited officials of the Government of Cuba” expansively, potentially cutting off remittances to hundreds of thousands of Cuban families. Finally, they prohibit anyone subject to U.S. jurisdiction from engaging in any “direct financial transactions” with entities controlled by the Cuban military or security forces that “disproportionately benefits” those entities.

All this marks the implementation of new sanctions Trump announced on June 16, 2017, at a Cuban American rally in Miami. The sanctions were mandated by the National Security Presidential Memorandum the president signed onstage, and included several major changes to the Cuban Assets Control Regulations (CACR), which spell out the operational details of the U.S. embargo.

Educational travel

In January 2011, Obama relaxed restrictions that former President George W. Bush had imposed on educational exchanges with Cuba – restrictions so onerous they eliminated most U.S. study abroad programs. Trump’s new regulations re-impose the Bush era restrictions, albeit with some exceptions for students accompanied by a representative of their U.S. academic institution. When combined with the State Department’s Sept. 29 travel warning advising people not to visit Cuba at all because of the injuries suffered by two dozen personnel at the U.S. embassy, the new restrictions on educational travel could drastically reduce U.S. study abroad in Cuba, which had been on the upswing since 2014.

U.S. visitors traveling under the “people-to-people” educational license (for educational travel not leading to an academic degree) can no longer travel on their own. They must now travel with organized groups under the auspices of a U.S.-based, licensed travel provider. Obama had lifted the group travel requirement in March 2016, providing an immediate boon to Cuba’s emerging private sector because individual travelers are much more likely to stay at private B&Bs (casas particulares), eat in private restaurants (paladares), take private taxis, and hire private guides. Most organized groups are too large for private rentals and thus have to be booked into government-owned hotels. Consequently, although Trump’s policy purports to boost Cuba’s private sector, the prohibition on individualized people-to-people travel hits the private sector hardest.

Although Cuban private businesses may suffer, the new travel regulations are not likely to put a huge dent in the number of U.S. visitors. The volume of travelers from the United States jumped dramatically in 2015, up 77 percent over 2014, after Obama and Cuba’s President Raúl Castro announced their intention to normalize relations in December 2014. This surge occurred before Obama ended the prohibition on individualized “people-to-people” travel. U.S. visitors are far more likely to be deterred by the State Department’s travel warning. Even then, a significant decline in U.S. visitors will not do serious damage to the Cuban tourist industry, which hosted four million foreign visitors in 2016 and is on track to host 4.7 million this year, of which only seven percent were non-Cuban American U.S. visitors.

Remittances

The new regulations redefine “prohibited officials of the Government of Cuba” to include all employees of the Ministry of the Revolutionary Armed Forces and Ministry of the Interior, thousands of ordinary Cubans who volunteer as leaders of their local Committees for the Defense of the Revolution, as well as senior government and party officials. The previous regulatory definition of prohibited officials, put into place by Obama in October 2016, was limited to members of the Council of Ministers and flag officers of the Revolutionary Armed Forces. The new definition encompasses hundreds of thousands of people, since the armed forces manage a significant number of commercial enterprises such as the Gaviota hotel chain and TRD Caribe retail stores, especially in the fast-growing tourism sector.

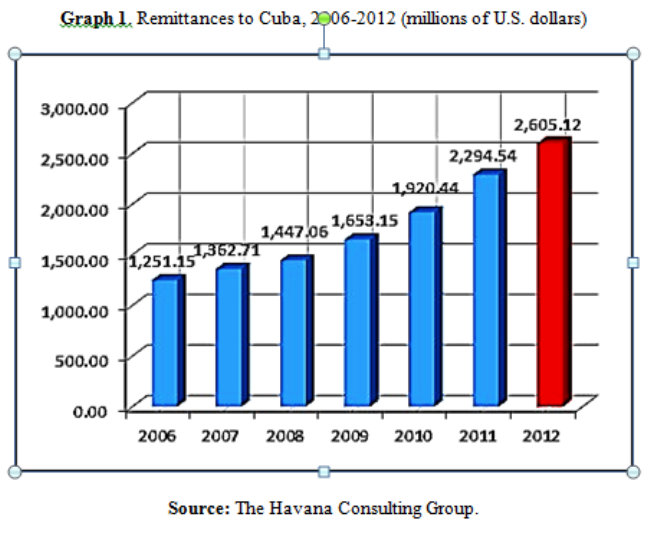

Cubans who are “prohibited” are not allowed to receive payments from U.S. nationals. That includes remittances and gift packages (Cuban Assets Control Regulations, §515.570), so the new regulations could potentially deprive hundreds of thousands of Cuban families of support from their relatives abroad. However, the actual impact is harder to predict. There is no way to enforce this prohibition since the U.S. government does not have a list of all the people covered in the expanded definition. Moreover, Cuban Americans can carry funds and gift packages to family when they travel or can wire funds through third countries, just as they did in 1994 when former U.S. President Bill Clinton tried, unsuccessfully, to cut off remittances to punish Cuba for the balsero (rafters) migration crisis.

Apart from whether the new prohibition proves effective, it would seem to run counter to the purported aim of Trump’s policy to empower the Cuban people by directing U.S. funds to them, rather than to the Cuban government. Remittances are by far best way to do that because the dollars go directly to family on the island.

Transactions with military-linked enterprises

The most complex regulatory change is the prohibition on engaging in any “direct financial transactions” with businesses controlled by the Cuban military or security forces if they “disproportionately benefit” those forces. This is a potentially significant prohibition because the Cuban armed forces ministry administers commercial holding companies involved in everything from banking and port management to hotels and retail sales. The presence of military enterprises is greatest in the tourist sector, where both U.S. visitors and U.S. companies are most likely to encounter them.

The U.S. Department of State was tasked with creating a list of prohibited enterprises, which it released along with the new regulations. The list includes 180 entities, 58 percent of which are in the tourist sector, including 84 hotels – by far the largest category of businesses included. Some of the entities listed are holding companies for hundreds of retail outlets, but U.S. travelers and companies can still do business with subsidiaries of prohibited entities so long as the subsidiaries themselves are not specifically listed. Quite reasonably, the State Department took the view that it could not expect travelers to know which retail outlets might be subsidiaries of prohibited entities unless they were specifically named.

Senator Marco Rubio (R-Fla.) and Representative Mario Díaz-Balart (R-Fla.), who were the intellectual authors of the ban on transactions with military-linked enterprises, complained that the State Department’s list was not inclusive enough because “bureaucrats” were “refusing” to carry out Trump’s policy. Rubio wanted to see the entire Cuban tourist sector put off-limits because the Minister of Tourism, Manuel Marrero Cruz, is a former military officer. According to Rubio, that means the entire sector is controlled by the armed forces.

The Cuban government was not happy with the sanctions either. Josefina Vidal, Director General for U.S. Affairs in the Foreign Ministry, said the new measures “confirm the serious regress of bilateral relations as a result of the decisions adopted by the government of the President Donald Trump,” and called some of them “subversive.”

In truth, the impact of these sanctions on commercial relations with Cuba is likely to be limited. The Cuban government, adept at coping with U.S. hostility for the past half century, may feel the pinch, but it can look elsewhere for trade partners and tourists. Also, in order to avoid disrupting ongoing business relationships, the new regulations exempt existing contracts from the prohibition on doing business with military-linked enterprises. So, for example, Marriott-Starwood Hotels’ contract to manage hotels owned by holding companies administered by the armed forces ministry is not affected by the new regulations. Moreover, even future contracts will be allowed with military-linked businesses involving ports, airports, and telecommunications, which are the three sectors in which most U.S. businesses (cruise ship lines, airlines, and cell phone companies) now operate.

On balance, the regulatory burden falls most heavily on U.S. academic institutions, whose study abroad programs in Cuba will be curtailed; on U.S. travelers who can no longer travel by themselves on a people-to-people educational license; on Cuban-Americans whose families on the island who will no longer be eligible to receive remittances and gift packages; and on U.S. businesses that may want to sell goods to Cuba in sectors where their counterparts are commercial enterprises managed by the armed forces ministry.

The Cubans who will suffer most are small business owners, suppliers, and employees who cater to individual U.S. travelers; employees of state firms managed by the armed forces ministry and their families, who may lose remittances and gifts; and Cubans who might have found employment with U.S. companies whose potential business deals are now blocked.

The Cuban state will suffer only marginally from Trump’s new sanctions – certainly not enough to force it into the sorts of concessions Washington demands.