RESPONSE BY MICHAEL WIGGIN

November 22. 23021

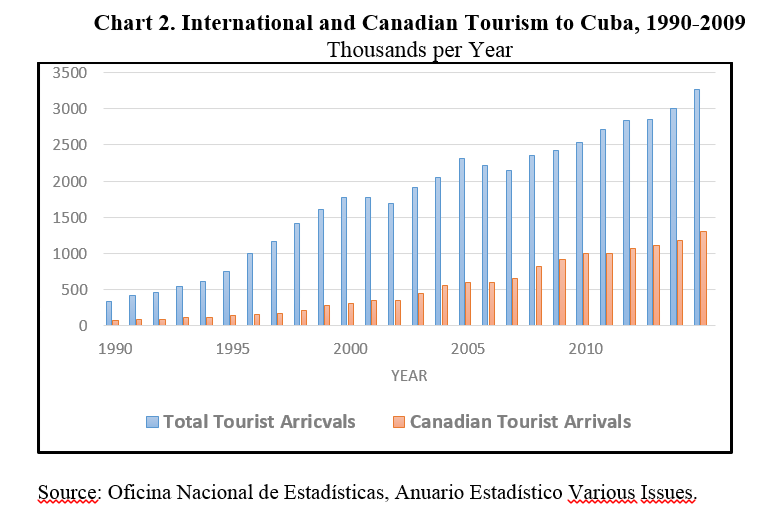

The article by Karel J. Leyva was, to me, disturbing. I think that it reflects the US government perspective of Cuba and not that of the many Canadians who spend time in and study Cuba and its history. Also, it does not recognize the progress of Cuba in the Caribbean and South American context where political turmoil is common and human rights abuses make those of Cuba seem minor. Also, the US support for dictators and the overthrow of democratically elected governments that lean to the left has been the norm, but only Cuba has been able to withstand the unrelenting US subversion.

It is also important to recognize the history of Cuba. Exploited first by the Spanish and then by the US who supported the likes of Batista and the US mob operations in Havana. It must be recognized that much of Cuba was exploited by US owned sugar plantations that provided a few months of work each year, restricted the ability of farmers to use vacant land and provided no social services, hospitals or schools. This resulted in oppressive conditions for many Cuban families and widespread illiteracy. But much of this changed after the Revolution which heralded high rates of literacy, more social equality. access to education and to health care. This has been followed by an enviable achievement in medical internationalism and support to other developing countries and the development of a pharmaceutical industry with many successes in tropical disease and COVID 19 vaccines.

All of this in the face of the US unrelenting blockade and covert support of dissidence. I am not saying that Cuba is perfect. There is much left to be done and Cubans are facing difficult times and much would be improved if the blockade were to be suspended. And if covert support for dissidents stopped, then the government would have no excuses for repression of Cuban’s expressing their frustrations. This is made worse by admitted erroneous reporting by the media.. Showing crowds of Cubans demonstrating in support of the Cuban government and then claiming them to be dissidents calling for the overthrow of the government is not constructive.

For outsiders, it is difficult to get access to fair media coverage and analysis. There are articles such as that by Leyva, but there is information from people recently or currently in Cuba who say that the coverage often reports legitimate demonstrations complaining about the pandemic or the economy as calls for regime change – which they often are not. If we want to help the people of Cuba, we need to focus on them and not political differences. Like all of the western democracies, we have been working on democracy since the Magna Carta in 1215 and had many revolutions and demonstrations along the way. Cuba has had 60 years. Let’s give them some breathing space for orderly self determination.

For now, Canada should avoid the US bandwagon, respect the incredible progress of Cuba from the colonial era and use our influence to stop the US embargo/blockade and covert efforts at regime change. Many Canadian visitors to Cuba and Canadian academics who specialize in Cuban issues share this view.

…..

CUBA, LE CANADA ET LES DROITS DE LA PERSONNE

Le vent de changement qui souffle sur Cuba et la répression grandissante doivent forcer le Canada à repenser ses relations bilatérales avec La Havane.

Original Article: Cuba, le Canada et les droits de la personne

par Karel J. Leyva, 11 novembre 2021

La nature dictatoriale du régime cubain a été reconnue à plusieurs reprises par des représentants du gouvernement canadien. En 2009, le ministre des Affaires étrangères Peter Kent a déclaré que Cuba est « une dictature, peu importe comment on la présente ». En 2016, Stéphane Dion, alors également ministre des Affaires étrangères, l’a reconnu lorsque la journaliste de Radio-Canada Emmanuelle Latraverse lui a demandé s’il trouvait approprié le ton employé par Justin Trudeau pour annoncer sa tristesse à la mort de Fidel Castro. La journaliste rappelait alors qu’il s’agissait d’un dictateur qui avait emprisonné des dizaines de milliers de Cubains et exécuté ses opposants. La même année, Justin Trudeau a fini par reconnaître que Castro était bel et bien un dictateur.

En 2018, le Canada est allé jusqu’à présenter au régime cubain une série de recommandations concernant les droits civils et politiques, dont celle de garantir que tout individu arrêté soit informé sans retard des raisons de son arrêt, qu’il ait accès à un avocat de son choix et qu’il ait droit dans des délais raisonnables à une audience publique où il est présumé innocent.

Lorsque le régime a brutalement réprimé les manifestations pacifiques de son peuple, le 11 juillet 2021, le gouvernement canadien a une fois de plus reconnu la nature dictatoriale du régime et ses violations des droits et libertés. Le ministre canadien des Affaires étrangères Marc Garneau a rencontré son homologue cubain pour lui faire part des profondes préoccupations du Canada concernant la violente répression des manifestations à Cuba, en particulier les détentions arbitraires et les mesures répressives contre les manifestants pacifiques, les journalistes et les militants.

Sans surprise, les recommandations canadiennes en matière de droits de la personne présentées à Cuba n’ont pas été prises en compte. Au contraire, comme le souligne le plus récent rapport d’Amnistie internationale, le gouvernement cubain continue de réprimer la dissidence sous toutes ses formes en emprisonnant des responsables politiques, des journalistes indépendants et des artistes, et en harcelant des poètes, des membres de la communauté LGBTQ et des universitaires.

Une attitude contradictoire

Ces prises de position du gouvernement canadien soutiennent la légitimité des revendications démocratiques du peuple cubain qui se traduisent, par exemple, par une augmentation soutenue du nombre de protestations politiques recensées par l’Observatorio Cubano de Conflictos. Mais, contrairement au traitement que le Canada réserve à d’autres dictatures, les dénonciations d’Ottawa n’ont aucune incidence sur ses relations bilatérales avec La Havane.

Contrairement au traitement que le Canada réserve à d’autres dictatures, les dénonciations d’Ottawa n’ont aucune incidence sur ses relations bilatérales avec La Havane.

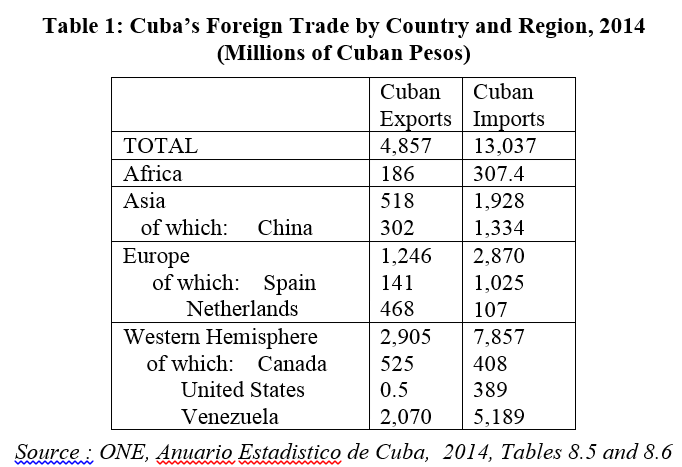

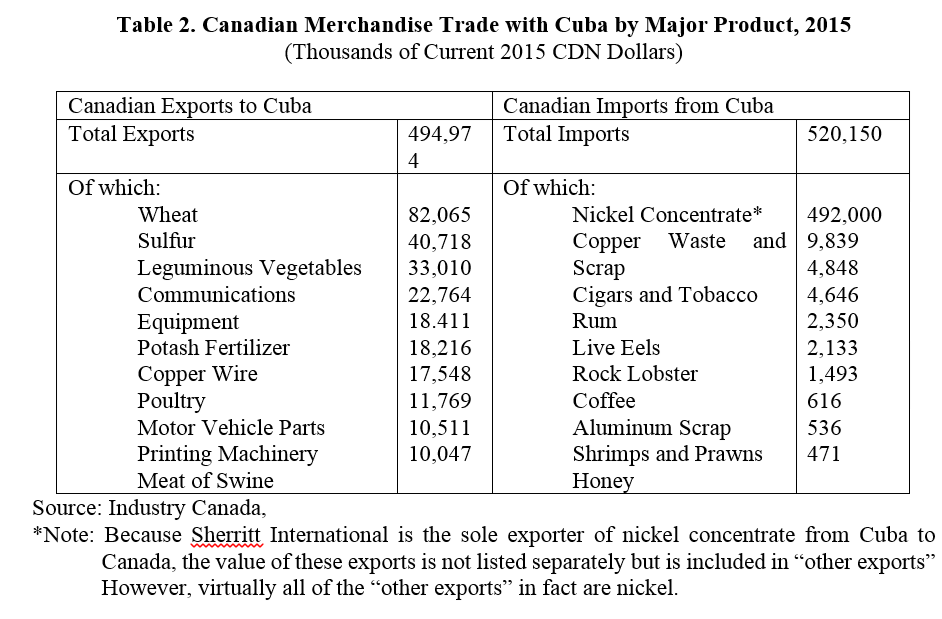

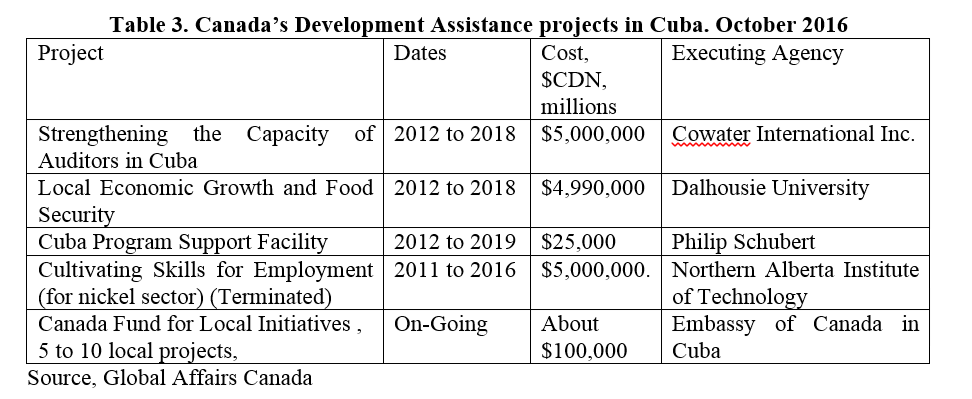

En fait, non seulement le Canada accorde de l’aide financière directe au régime de La Havane, mais il a également harmonisé sa programmation de développement international avec certaines priorités définies par le gouvernement cubain. D’autres régimes autoritaires ne jouissent pas du même traitement. Par exemple, l’aide humanitaire que le Canada accorde à la Corée du Nord se transmet par le biais de partenaires multilatéraux, car le Canada n’apporte aucune contribution financière directe à ce régime. Des sanctions semblables ont été imposées au Nicaragua et au Venezuela afin d’envoyer un message clair en ce qui a trait aux droits de la personne.

Le cas de Cuba demeure une exception. L’intolérance du Canada face aux violations des droits civils et politiques dénote donc une attitude à géométrie variable.

Une situation qui se dégrade, malgré des pressions qui s’intensifient

La résolution du Parlement européen sur la situation des droits de l’homme et la situation politique à Cuba, adoptée en juin 2021, souligne que depuis l’entrée en vigueur, il y a quatre ans, de l’Accord de dialogue politique et de coopération avec Cuba, non seulement ce pays n’a accompli aucun progrès au regard des objectifs définis par l’accord, mais le régime cubain a intensifié la répression et les violations des droits de l’homme. La situation politique et économique s’est détériorée, provoquant une nouvelle vague d’actions de résistance pacifique violemment réprimées par le régime.

Un article d’Options politiques publié en 2006 soulignait que la politique d’engagement constructif du premier ministre Chrétien à l’égard de Cuba n’a favorisé ni la démocratisation ni l’amélioration de la situation des droits de la personne. De même, les politiques de négligence « relativement bénigne » des premiers ministres Martin et Harper n’ont pas eu d’effet sur Cuba non plus. Et le gouvernement actuel ne montre pas de volonté franche à faire progresser les droits et libertés des Cubains. Il serait donc temps que le Canada repense ses relations bilatérales avec le régime de La Havane. Le Canada doit trouver un équilibre entre la realpolitik et son engagement à promouvoir la démocratie et les droits de la personne. C’est le peuple cubain, et non le régime, qui « a besoin de plus de Canada ».

L’insoutenable ambivalence du Canada

On pourrait se demander quel serait l’impact réel de l’application de sanctions canadiennes sur un régime qui, depuis des décennies, a démontré une grande résilience face aux pressions internationales, notamment américaines. Au-delà du fait qu’en matière de droits de la personne, adopter une moralité politique à géométrie variable n’est pas une attitude éthiquement acceptable, le contexte politique actuel justifierait pleinement un changement de posture de la part du gouvernement du Canada. Voici cinq tendances récentes qui soutiennent cette affirmation.

Le contexte politique actuel justifierait pleinement un changement de posture de la part du gouvernement du Canada

Premièrement, bien que le gouvernement cubain ait toujours violé de manière systématique les droits de la personne, ces violations se sont aggravées considérablement au cours des dernières années. Depuis le rassemblement de plus de 300 artistes, intellectuels et journalistes devant le ministère de la Culture, le 27 novembre 2020, pour réclamer le droit à la liberté d’expression et la cessation de la répression, le nombre de détentions arbitraires n’a fait qu’augmenter. Selon les rapports de l’Observatoire cubain des droits de la personne, entre février et juin 2021, 2 906 actions répressives, y compris 734 détentions arbitraires, ont eu lieu à Cuba. L’ampleur de la répression s’est accrue après le 11 juillet, lorsque des centaines de milliers de Cubains ont marché pacifiquement pour réclamer la démocratie. Les manifestants ont été accueillis par des balles, des passages à tabac et des chiens lâchés sur eux. Par la suite, les agents de sécurité de l’État n’ont eu de cesse de se rendre au domicile de manifestants identifiés, de les détenir sans mandat d’arrêt, puis de les condamner lors de procès sommaires souvent menés sans avocat. Le rapport de Prisoners Defenders du 6 octobre 2021 souligne qu’un record historique de 525 prisonniers politiques au cours des 12 derniers mois vient d’être établi à Cuba. Ce document estime entre 5 000 et 8 000 le nombre d’arrestations arbitraires des suites de violences policières depuis le 11 juillet, parmi lesquelles certaines victimes ont dénoncé des tortures. Les personnes qui ont déjà été libérées l’ont été au prix d’amendes très élevées équivalant à plusieurs mois de salaires à Cuba. Selon un document produit par l’ONG Cubalex, certains font face à des peines de prison allant jusqu’à 27 ans. Un citoyen canadien de 19 ans a été emprisonné et est actuellement obligé d’effectuer des travaux forcés, malgré de graves problèmes de santé.

Deuxièmement, la nature même des violations a pris une nouvelle ampleur durant cette même période. Domiciles de militants assiégés, menaces, harcèlement, coupures d’Internet, amendes élevées, actes de répudiation et licenciements sont devenus la norme à Cuba. En outre, le récent décret-loi 35, qui renforce les contrôles sur la liberté d’expression dans les médias sociaux à Cuba, contrevient aux dispositions des articles 41, 46, 50 et 54 de la Constitution de la République de Cuba, tout en étant contraire aux traités internationaux ratifiés par le gouvernement de ce pays. De plus, les acteurs ciblés ne sont plus exclusivement des dissidents politiques. Ce sont des adolescentes menacées de viol par des agents de l’État, des journalistes contraints de se déshabiller devant des militaires dans une salle d’interrogatoire ou humiliés et agressés sexuellement, des grands maîtres des échecs en grève de la faim détenus arbitrairement, des médecins et des professeurs expulsés de leur emploi pour avoir fait la promotion du respect des droits fondamentaux, des poètes harcelés par la police à leur domicile, des jeunes de 14 à 17 ans détenus et des activistes forcés de rester dans leur maison durant des mois. Pour le Canada, il n’est désormais plus possible de croire l’argument traditionnel du gouvernement cubain selon lequel la contestation serait alimentée par des groupes radicaux basés à Miami.

Il n’est désormais plus possible de croire l’argument traditionnel du gouvernement cubain selon lequel la contestation serait alimentée par des groupes radicaux basés à Miami.

Troisièmement, il existe une conscience internationale croissante à l’égard de la dégradation du respect des droits de la personne à Cuba et une conviction morale que la situation qui en résulte est inacceptable. À la suite des sanctions de l’administration Biden envers des responsables des attaques contre les manifestants cubains, le Parlement européen a émis une résolution, le 16 septembre 2021, sur la répression gouvernementale visant les manifestations et les citoyens à Cuba. La naissance du mouvement 27N et la répression constante de ses membres ont donné une nouvelle visibilité à la fois nationale et internationale à la situation des droits de la personne à Cuba. Des publications sur ce mouvement dans la revue du Museum of Modern Art de New York en font foi, tout comme la nomination de l’artiste Luis Manuel Otero Alcántara, leader du mouvement 27N emprisonné le 11 juillet, parmi les 100 personnalités les plus influentes de l’année selon le magazine Time. Les nombreuses manifestations contre la dictature organisées par des Cubains en exil aux quatre coins du monde ont également contribué à cette visibilité.

Quatrièmement, la communauté de Canadiens d’origine cubaine est devenue très active politiquement. Des dizaines de manifestations exigeant du gouvernement canadien des mesures concrètes contre la dictature cubaine ont déjà eu lieu au Canada. Des pétitions ont été présentées à la Chambre des communes demandant au gouvernement canadien de soutenir le peuple cubain face à la forte intensification de la répression. Des rencontres ont été organisées avec des sénateurs et des députés pour exiger que le Canada s’engage envers les droits de la personne et la démocratie à Cuba. Le gouvernement fédéral se trouve ainsi sous la pression des politiciens et de la société civile canadienne, qui lui demandent tous de mettre fin à sa complaisance à l’égard du régime de La Havane.

Enfin, la tendance à la hausse du nombre de protestations politiques à Cuba depuis 2020 s’est cristallisée dans l’explosion sociale survenue le 11 juillet dans plus de 60 endroits, événement sans précédent en 62 ans de dictature. Il serait faux de réduire les revendications de ce mouvement aux seuls enjeux économiques et sanitaires. Les vidéos qui circulent montrent le peuple cubain demandant liberté et démocratie. Pour seule réponse, le président cubain a ordonné aux « révolutionnaires » de réprimer et de battre les manifestants pacifiques.

Néanmoins, malgré la peur que cette période de terreur a générée au sein des familles cubaines, de nouveaux mouvements sociaux et des alliances sont en train de se créer dans la société civile du pays. De nouvelles marches pacifiques sont prévues, comme celle qui est organisée pour le 15 novembre prochain par le groupe de la société civile cubaine Archipiélago – une nouvelle plateforme de représentation citoyenne – et le Conseil pour la transition démocratique à Cuba.

Le gouvernement a répondu en convoquant à plusieurs reprises les signataires devant les autorités et en les menaçant d’emprisonnement. Il a également eu recours à la diffamation publique, à des coupures de téléphone et d’Internet, et à l’intimidation. La maison du leader d’Archipiélago a été vandalisée avec des pigeons décapités, de la terre et du sang. Les rues commencent déjà à se militariser et le gouvernement arme des groupes au moyen de fusils automatiques et de bâtons. Les images qui circulent donnent froid dans le dos et beaucoup craignent que la journée ne se solde par des violences et des emprisonnements. Dans le but de soutenir la marche, la société civile transnationale cubaine a organisé des manifestations dans 80 villes à travers le monde, dont Montréal, Ottawa, Toronto et Calgary.

Le Canada devrait accompagner le peuple cubain dans sa quête de liberté au lieu de se contenter de soutenir, comme il le fait, le « processus de modernisation de l’économie » amorcé par le régime ou de lui fournir une aide financière dont le peuple ne bénéficie pas, mais qui semble plutôt servir à acheter des équipements antiémeutes modernes jamais vus auparavant à Cuba. Pourquoi un gouvernement qui, l’an dernier, en pleine crise sanitaire et économique, a importé d’Espagne pour plus d’un million d’euros de matériel militaire aurait-il besoin de l’aide financière du Canada ?

Un aveu de complicité

Refuser de sanctionner les responsables de ces violations des droits de la personne constitue un aveu de complicité avec un régime en pleine décadence qui n’a aucune légitimité politique et qui est même condamné sur la scène internationale pour esclavage moderne. Non seulement une telle abstention minerait l’image du Canada en tant que l’un des principaux défenseurs des droits de la personne dans le monde, mais il mettrait le pays sur la sellette par rapport au traitement à la carte qu’il réserve à différentes dictatures. Le Canada a signé avec les États-Unis et le Parlement européen une déclaration commune appelant à un processus de négociation global dans le but de restaurer les institutions au Venezuela, d’y organiser des élections crédibles et de revoir les sanctions en fonction des progrès réalisés dans ce pays. Comment, alors, expliquer qu’il n’envisage même pas de repenser ses relations avec le régime de La Havane, qui non seulement commet lui aussi des violations flagrantes de droits et des libertés, mais qui est considéré comme un acteur crucial de la crise vénézuélienne ?

Fort de sa réputation de défenseur des droits et libertés partout dans le monde, le Canada pourrait jouer un rôle décisif en joignant sa voix au nombre grandissant de celles qui soutiennent une transition démocratique à Cuba.