Analysis Original: La generación de electricidad en Cuba

¿Qué es el esquema Boot y por qué no se utiliza más en Cuba para invertir en fuentes de energía eficientes?

Por Omar Everleny,

OnCuba, enero 13, 2022

El año pasado la prensa dio a conocer ampliamente la llegada a Cuba de una nueva central flotante para la generación de electricidad. Operada por una empresa de Turquía, se puso en funcionamiento en el Puerto de La Habana, cerca de las instalaciones de la termoeléctrica de Tallapiedra. Se trata de la segunda central flotante de este tipo después de otra de la misma empresa que ha estado funcionando en el puerto del Mariel.

Ante los problemas con la generación de electricidad para responder a la demanda sin los incómodos apagones y mantener los ciclos de mantenimiento de las termoeléctricas existentes, la decisión adoptada de contratar el buque turco parece muy adecuada a las circunstancias. La tecnología existente permite esta solución rápida y eficaz.

Pero también nos hace caer en una especie de déjà vu. Cuando hace unos años atrás estábamos en apagones y búsqueda de soluciones, se tomó la decisión de empezar la llamada Revolución Energética o “una Revolución dentro de la Revolución”. La salida en aquel entonces fue establecer plantas de emergencia o grupos electrógenos de diferentes tamaños y potencias de generación. Esto permitía, entre otras bondades, las siguientes:

- Contar en poco tiempo con capacidad instalada, adecuada a las necesidades, sin grandes y costosas construcciones civiles.

- Tener instalaciones desplazadas por toda la Isla, muy útiles en caso de desastres naturales, sabotajes o un conflicto externo.

No obstante, al parecer de algunos expertos esta decisión, si bien resultaba muy conveniente para soluciones inmediatas y hasta estratégicas, no parecía la mejor a largo plazo. Y la vida les ha dado la razón, toda vez que:

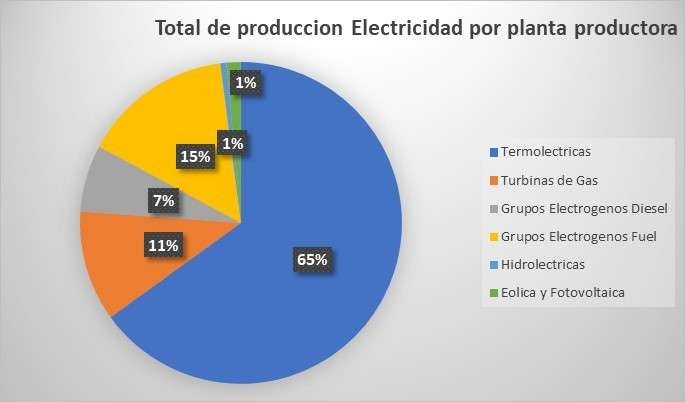

- Las tradicionales termoeléctricas siguen siendo las plantas de generación más eficientes comparándolas con los grupos electrógenos. Los problemas de aquellos tiempos comenzaron con una importante rotura en la Central Termoeléctrica (CTE) Antonio Guiteras de Matanzas. Pero hoy la Guiteras sigue siendo de las más eficientes del país.

- El costo del fuel-oil o del diésel, utilizados en los grupos electrógenos, es más elevado que el del crudo que emplean en las tradicionales Centrales Termoeléctricas, incluso cuando para estas últimas hay que adquirir disolventes/diluyentes para poder utilizar el pesado crudo cubano.

- Los grupos electrógenos generan la capacidad instalada y se adaptan menos a los cambios en la demanda puntual. Las CTE pueden más fácilmente generar o reducir generación, según los picos de la demanda de electricidad.

- Los grupos electrógenos funcionan con motores de combustión interna, menos duraderos que las unidades de generación de las CTE, es decir, se descapitalizan más rápido.

La decisión tomada en aquel entonces pudiera haber sido muy acertada para una solución inmediata y a corto plazo, pero no parecía una decisión que solucionara el problema a largo plazo. Los problemas de hoy parecen demostrar esta idea.

También pudiera pensarse que no había otra salida debido a lo costoso que sería erigir nuevas CTE, al margen de lo que demoraría su construcción. Es cierto que el país no pudo contar con financiamiento externo o recursos propios para construcciones de estas magnitudes. Sin embargo, hay variantes.

En el mundo hace tiempo existen los contratos conocidos como Boot (del inglés build, own, operate and transfer) o «construir, mantener la propiedad, gestionar y transferir», una forma moderna de conjugar recursos públicos y privados para viabilizar obras públicas de envergadura o para atender necesidades de infraestructura sin tener que invertir el dinero público. Esto permite que un inversionista construya algo, durante unos años mantenga la propiedad del bien construido, gestione el negocio y después le transfiera la propiedad al Estado.

Los años de conservación de la propiedad permiten al inversionista amortizar la inversión realizada y obtener una rentabilidad en unos años adicionales después de la amortización del bien. Este esquema le permite al país no tener que movilizar recursos frescos en nuevas y costosas inversiones, ni ocuparse del mantenimiento de los activos mientras son propiedad del inversionista extranjero.

Lo curioso del caso es que Cuba tiene experiencias de este tipo. En 1999, antes de la Revolución Energética, con un esquema similar se aprobó una empresa cubana de capital totalmente extranjero de Panamá, conocida como Genpower Cuba S.A., para la generación de electricidad en la Isla de la Juventud. Se cumplió todo lo pactado en ese tipo de negociación.

Han pasado 16 años desde el comienzo de la Revolución Energética en 2005, y se sigue con una solución que parece coincidir con el otro nombre común de los grupos electrógenos de emergencia.

No es de extrañar entonces que se haya tenido que acudir a las centrales flotantes turcas si en todos estos años no se ha encontrado una solución más estable y duradera a los problemas de generación de electricidad en la Isla.

¿Fue negativa la experiencia con Genpower Cuba? ¿En todos estos años no hubiese sido posible encontrar inversionistas extranjeros para erigir nuevas CTE bajo el esquema Boot? ¿No son las CTE más eficientes que los grupos electrógenos y más duraderas en el tiempo?

A los turcos hay que pagarles la electricidad comprada por Cuba, pero la propiedad del buque seguirá siendo del dueño extranjero. Mientras, una CTE construida bajo esquema Boot, al final pasaría a ser propiedad de Cuba. Es algo así como comparar la adquisición de una casa con financiamiento que al final del pago de la hipoteca será sin restricciones totalmente de uno con vivir toda la vida en alquiler.

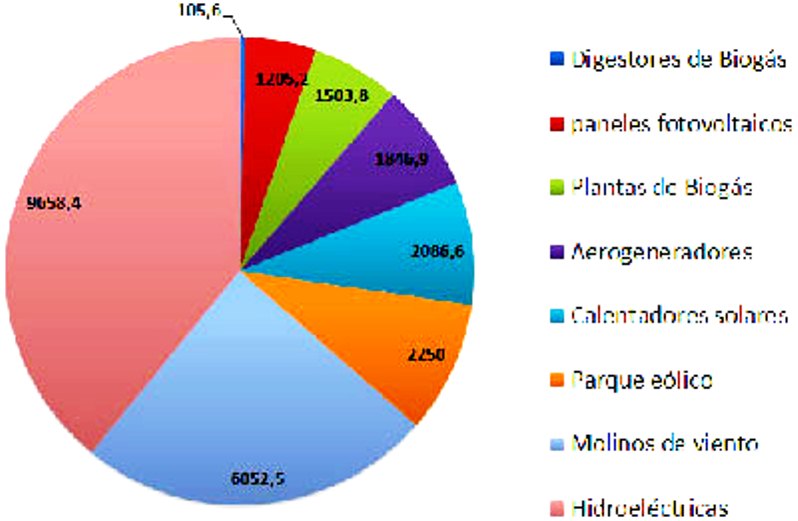

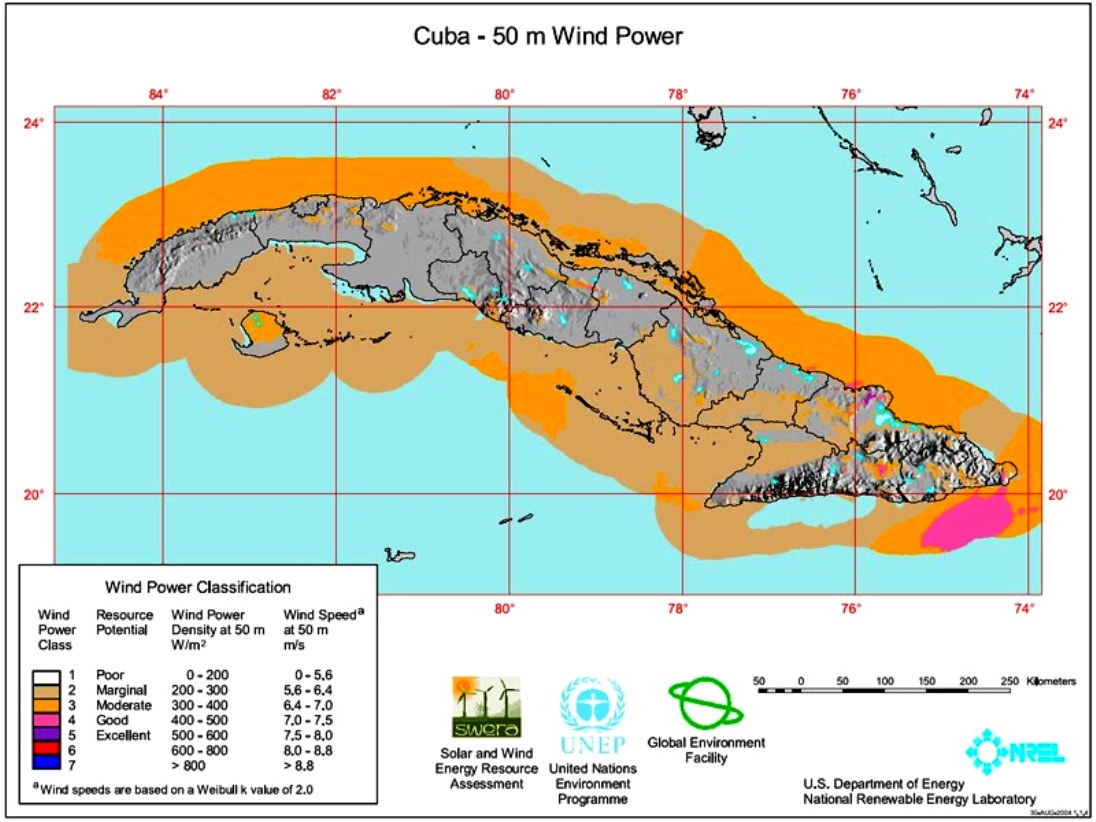

Con el auge de las energías renovables, la intención es reducir la emisión de gases de efecto invernadero y cambiar la matriz energética, de manera que las primeras ocupen un mayor porcentaje en el total de la generación. Pero cabría también hacerse otras preguntas: ¿no es posible encontrar inversionistas extranjeros dispuestos a construir plantas eólicas, fotovoltaicas u otras de energías renovables bajo el esquema Boot? ¿En la Zona de Desarrollo del Mariel no se han acercado inversionistas extranjeros con propuestas de plantas de energía renovables? Aunque está la excepción de producir energía eléctrica por paneles fotovoltaicos por la empresa Mariel Solar Energy GSY Ltd. de Reino Unido, en proceso inversionista desde agosto de 2017.

En la más reciente Cartera de Oportunidades de Inversión para 2022 aparecen nueve proyectos para la construcción de Parques Solares Fotovoltaicos con la propuesta de producir unos 220 mw en conjunto en algunos territorios del país, sumado a cinco propuestas para construir bioeléctricas en algunos centrales, con un promedio de inversión de 130 millones de dólares, algunos de 120 millones y otros de 140 millones de dólares. ¿Estarán creadas las condiciones para que el inversionista extranjero invierta esas cantidades en el país?

Se espera que el Estado cubano esté pensando en no caer más en la necesidad de apagar amplias zonas del país, dada la falta de producción eléctrica en determinados momentos. Entiendo que las autoridades no lo deseen, pero esos deseos tienen que materializarse en inversiones sólidas y a más largo plazo. ¿Estarán en plan esas nuevas plantas de producción eléctrica en el futuro? Ojala que sí.