By Marc Frank

Reuters, October 20, 2021

Original Article: Cuba, Paris Club Reach Deal to Skip 2021 Debt Payment

HAVANA, Oct 20 (Reuters) – Cuba has reached a deal with the Paris Club of creditor nations to postpone an annual debt payment due in November until next year, according to diplomats from five of the governments involved, the latest sign the Communist-run country is suffering a grave foreign exchange crisis.

The historic 2015 Paris Club agreement with Havana forgave $8.5 billion of $11.1 billion in sovereign debt Cuba defaulted on in 1986, plus charges. Cuba agreed to repay the remainder in annual installments through 2033, but only partially met its obligations in 2019 and defaulted last year.

The outlines of an amended deal, worked out between the parties in June and not previously reported, calls for resumption of payments in 2022 and adjustment of the payment schedule, the diplomats said, requesting anonymity to comment.

The Cuban government and Paris Club had no comment on the matter.

The parties in June said in a statement that “this agreement provides more time to the Republic of Cuba to honor several payments due under the 2015 Arrangement, while maintaining the present value of these amounts.”

Cuba has now fallen behind by around $200 million on payments, including this year, the diplomats estimated.

It is not clear if penalties will apply as the pandemic crunch has led lenders to waive fees on other debtor nations. Cuba said this week it had vaccinated 99.2% of its population with at least one dose of its locally developed COVID-19 vaccines, and plans to reopen its borders to international tourism by mid-November after nearly two years of coronavirus-induced stagnation.

The Caribbean island nation depends heavily on tourism to inject much-needed foreign exchange into its otherwise inefficient state-run economy, and for the cash it needs to repay lenders.

“I expect a fairly robust return of tourists impacting other activities and that should improve the outlook somewhat for payment in 2022,” one of the diplomats said.

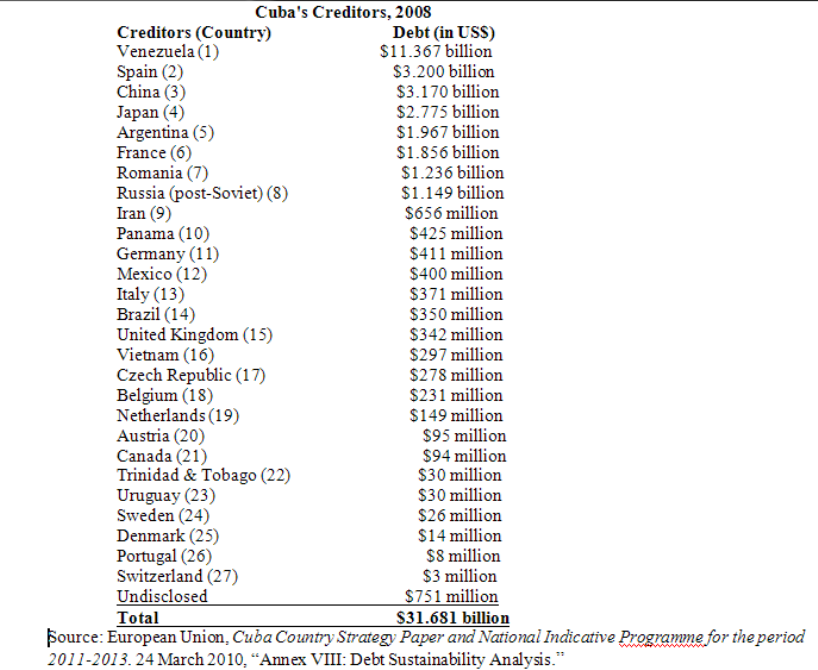

Over the last decade, Cuba also restructured debt with Russia, China, Germany, Mexico and Japanese commercial debt holders.

“Its my understanding most of those payments are also on hold,” another diplomat said, with a colleague seconding that view.

Harsh U.S. sanctions on vital foreign exchange earners such as tourism, remittances and foreign investment, many implemented under then-U.S. President Donald Trump and maintained under his successor, Joe Biden, also complicate inflows.

Foreign exchange revenues fell by some $4 billion beginning in 2020 and the import of basic goods and inputs for agriculture and production in general plunged nearly 40% as a result, the government reported.

The economy contracted 10.9% last year and another 2% through June, compared with the same period in 2020, resulting in shortages of food, medicine and other basic goods. The government this year predicts the economy to grow 2%, just barely beginning to recoup last year’s downturn.

Under the original Paris Club agreement, seen by Reuters, interest was forgiven through 2020, and after that was just 1.5% of the total debt still due. Some of that money due was allocated to funds for investments in Cuba. The diplomats who spoke to Reuters said they did not expect any significant changes to that portion of the agreement.

Cuba last reported foreign debt of $18.5 billion in 2018, and experts believe it has risen since then, especially to suppliers and investment partners who reported serious payment issues as early as 2018. The country is not a member of the International Monetary Fund or the World Bank.

The Cuba group of the 22-member Paris Club comprises Australia, Austria, Belgium, Canada, Denmark, Finland, France, Britain, Italy, Japan, the Netherlands, Spain, Sweden and Switzerland.