By Arch Ritter

As part of the policy reforms designed to absorb almost 1.2 million redundant state sector workers into the private sector, the Government of Cuba has modified the micro-enterprise tax regimen. Some of the modifications were positive in the sense that they will reduce the heavy tax burden on self-employment. However, the changes are modest, and the tax system will continue to limit job-creation and the expansion of micro-enterprise.

Bicitaxis, Central Havana

Bicitaxis, Central Havana

I. The New Tax Regime

The new taxation system, presented in the Gaceta Oficial, número 11, and Gaceta Oficial, número 12 on October 1 and 8, 2010, has five components:

1. Sales Tax on Goods

2. Tax on Hiring of Workers

3. Income Tax

4. Surtax on Services

5. Social Security or Social insurance Payments

Taxes generally will now be payable in Moneda Nacional or “old” pesos. For purposes of tax payment, taxes owing in convertible pesos (CUCs) are to be exchanged into Moneda Nacional at the going quasi-official rate (around 22 to 26 “old” pesos per convertible peso, over the 2001-2010 period). There is a special regimen for bed-and-breakfast operations that is not considered here.

1. Sales Tax

This is a 10% tax levied on the value of sales of goods and payable by all micro-enterprises that do not qualify for the Simplified Tax Regime (See 3. below.) While this tax in principle is reasonable and is used in most countries, the administrative cost of monitoring the value of sales and collecting the tax for the many of the smaller self-employed activities will be high.

2. Tax on the “Utilization of Labor”

This tax on the hiring of employees is set at “25% of 150%” (that is, 37.5%) of the average national wage which was 429 pesos per month in 2009 (ONE, AEC Table 7.4). The tax would thus be about 161pesos per month per employee or 1,932 pesos per year.

A “Minimum” requirement for the hiring of employees for tax determination purposes is set at two employees for paladares and one for other food vendors and a few other activities. There appears to be no exception or adjustment of the tax for part-time employees.

(Note that some 74 self-employment activities are prohibited from hiring employees and another 7 can hire one employee only.)

3. The Income Tax

There are two tax income regimes, a simplified regime for lesser self-employment activities and a more complex regime for larger activities.

The Simplified Tax Regime applies to some 91 activities. In place of the income tax, sales tax, tax on public services, they instead pay a consolidated tax, constituted by the monthly licensing fee which ranges from 40 to 150 pesos per month, payable in the first ten days of each month. (It is unclear whether overpayments would be refunded – they were not under the previous system.)

Other enterprises fall under the general tax regime, and pay all of the individual taxes discussed here. These activities pay the up-front monthly tax/license ranging from 40 to 700 pesos per month.

For the determination of the tax payment, the “tax base” is defined as total revenue less a fixed amount for deductible expenses. The maximum amounts allowed for deductible expenses range from 10% for 10 activities, 20% for room rental operations, 25% for 40 activities, 30% for 10 activities and 40% for 6 food and transport activities. (Bed and breakfast operations have their own specific regimen.)

The income tax rates rise progressively from 0% for the first 5,000 pesos, through 25% for additional income between 5,000 and 10,000, 30% for income increments from 10,000 to 20,000, 30% for 20,000 to 30,000, 40% for 30,000 to 50,000 and 50% for additional income exceeding 50,000.00 pesos. This rate is high but not unreasonable in international comparison.

4. Sales Tax on Services

A 10% additional sales tax is levied on services provided by micro-enterprise. Those enterprises qualifying for the Simplified Tax Regime are exempt from this tax.

5. Social Security Payments

These payments are destined ultimately for old age support, maternity leave, disability and death in the family. They are determined according to a scale that the self-employed worker selects, and may range from 25% of 350 to 2000 pesos per month depending on the choice of the self-employed person. This is a social insurance scheme though the payments are similar to taxes.

II. Evaluation of New Tax Arrangement

This new tax regime represents a minor improvement over the previous regime. The main improvement is that it permits the deduction as costs of production of more than a maximum of 10% of total revenues as was the case previously. This is a reasonable adjustment to the tax base as most of the self-employed activities generate costs that are higher than the maximum allowable 10% of total revenues. This is especially beneficial for activities such as gastronomic, transport and handy-craft or artisan activities for which input costs are far beyond 10% of total revenues.

The progressive structuring of the income tax regime is reasonable though stiff.

However there are a number of flaws in the taxation regimen which will continue to stunt the development of small enterprise and will prevent the absorption of the redundant workers being displaced from the public sector.

1. The Blocking of Job-Creation

First, the tax on employment is problematic as it adds to the employer’s cost of hiring a worker. The obvious impact of this tax will be to limit hiring and job creation. Or employment will be “under the table”, unrecorded, and out of sight of officialdom.

2. Onerous Overall Tax Levels

The overall tax level is punitive. The sum of the income tax, employee hiring tax, and public service surtax is high- and as noted below can help create effective tax rates exceeding 100%, as is explained on Section III. This will continue to promote non-compliance. It will discourage underground enterprises from becoming legal. The establishment of new enterprises will be discouraged.

3. Erroneous and Unrealistic Base for the Income Tax

The most serious shortcoming of the income tax regime involves the tax base which is not “net revenues” after the deduction of input costs, but an arbitrary proportion of total revenues.

The tax regime limits the maximum for input costs deductible from total revenues to 10 to 40% depending on the type of enterprise involved. When the actual micro-enterprise input costs exceed the maximum allowable, the tax rate on true net income can become very high. In the example below, the effective tax rate (defined as the taxes payable as a percentage of true net income) can exceed 100%. Obviously this would kill the enterprise and promote cheating and non-compliance. It will discourage underground economic activities from becoming legal and block the establishment of new enterprises.

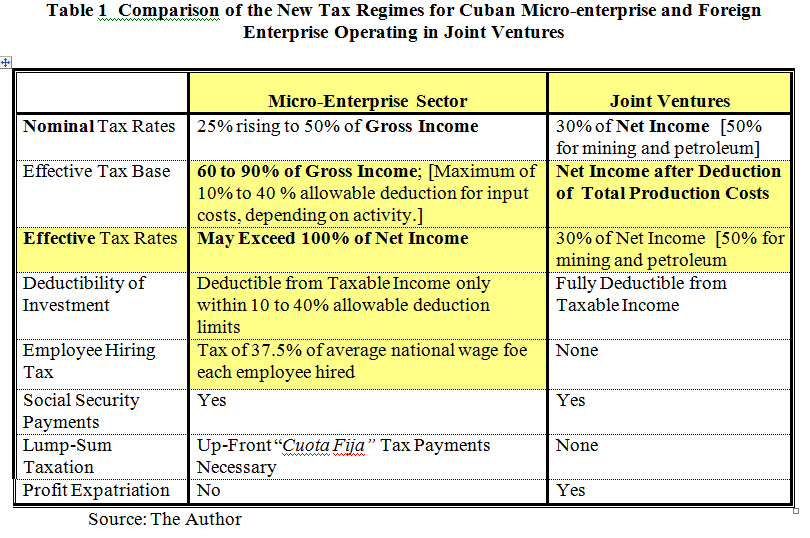

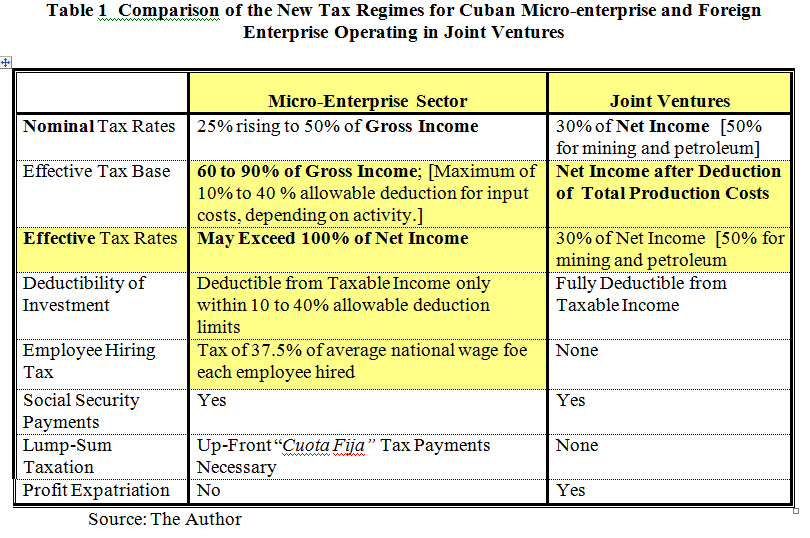

4. Continued Discrimination versus Cuban Enterprise in Favor of Foreign Enterprise

The minor reforms of the micro-enterprise tax regime do relatively little to reduce the fiscal discrimination favoring foreign enterprise. (See Table 1.) The main difference is the determination of the effective tax base which is total revenues minus costs of production for foreign firms but for micro-enterprise is gross revenue minus an arbitrary and limited allowable level of input costs. The result of this is that the effective tax rates for foreign enterprises are reasonable but can be unreasonable for Cuban microenterprises. For Cuban micro-enterprises, the effective tax rate could reach and exceed 100%.

Moreover, investment costs are deductible from future income streams for foreign firms this being the normal international convention. But on the other hand, for Cuban micro-enterprise, investment costs are deductible only within the 10 to 40% allowable cost deduction levels.

III. Example: Three Taxation Cases for a Paladar or Restaurant

To illustrate the character of the tax regime, a case of a “Paladar” is examined below. It is assumed that the total revenues or gross earnings of the Paladar are 100,000 pesos per year (Row 1) or a modest 280 CUP or about $US 10.50 per day.

It is imagined then that there are three costs of production cases: Case A, B and C where costs of production are 40%, 60 and 80% of total revenues respectively. A situation where input costs for a Paladar are 80% of total revenues is reasonable, given the required purchases of food, labor, capital expenses, rent, public utilities etc. On the other hand, the 40% maximum is unreasonably low.

The differing true input cost situations (Rows 2 and 3) generate different true net income (Row 6). The tax base however is determined by the legal maximum allowable of 40,000 (Row 4 and 5) and is 60,000 pesos in all three cases (Row 7). The income tax payable is determined by the progressively cascading scale noted above and is 19,750 in all three cases (Row 8, based on calculations not shown here). The tax on hiring the legal minimum two employees is 25% of 150% (that is, 37.5%) of the average national wage which was 429 pesos per month or 161 pesos for 12 months for two employees = 3,864 pesos per year (Row 9). A guess for the surtax on use of public services is 1,200 pesos per year (Row 10). The total taxes then are the sum of Rows 8 t0 10 and are 26,614 per year (Row 11).

The effective tax rate is then calculated as Tax Payment as a percentage of Actual Net Income (Row 11 divided by Row 6). For the third case where true costs of production are 80% of total revenues, the effective tax rate turns out to be well over 100% (124.1%). This is due to fixing the maximum allowable for costs in determining taxable income at an unrealistic 40% while the true costs of production were 80% of total revenues.

The chief result of this example is that effective tax rates can be much higher than the nominal tax rates for all the activities where true input costs exceed the defined maximum. In some cases, taxes owed could easily exceed authentic net income – assuming full tax compliance. This situation likely occurs for all activities not covered by the simplified tax regime.

Such high effective rates of taxation of course could destroy the relevant microenterprise, and block the emergence of new enterprises. While under the previous policy environment for microenterprise, this was perhaps the objective of policy. However, the objective of the new policy environment is to foster and enable micro-enterprise and to create jobs.

IV. Conclusion

Can the Micro-enterprise sector generate about 500,000 new jobs by April 2011 and 1.2 million in the next year? On the positive side, there have been some measures of a non-tax nature (e.g. the stigmatization has been relaxed, licensing has been liberalized; there has been a minor increase in legal activities; prohibitions and regulations have been eased somewhat; and improved access to inputs will likely be possible.) But on the negative side, a narrow definition of legal activities will limit enterprise and job creation; the prohibition of professional activities remains; restrictions and prohibitions on hiring workers remain; and restrictions and prohibitions remain.

The timid revisions of the tax regimen will not facilitate job creation in the microenterprise sector.

- The high level of taxes generally will limit enterprise creation and legalization.

- The underground economy will continue to be encouraged.

- The tax on the hiring of employees will discourage the absorption of labor into microenterprise activity.

- Microenterprises will remain stunted by the high effective tax rates that are incurred when costs of production exceed the minimum deductible for tax determination purposes.

- The tax discrimination favoring foreign firms in joint ventures continues.

In order for the micro-enterprise sector is to expand so as to absorb the 1.2 million redundant public sector workers in the process of being fired, further reform of the tax system is necessary.

Raul Castro and the Council of Ministers, Granma, March 1, 2011

Raul Castro and the Council of Ministers, Granma, March 1, 2011

Photographer, at the Capitolio circa 1996, (Photo by A, Ritter)

Photographer, at the Capitolio circa 1996, (Photo by A, Ritter)