Posted: 03/26/2015 2:17 am; 14 y medio, El Pais and Huffington Post.

Yoani Sanchez

Original here: CUBA: THE DAY PEACE BROKE OUT

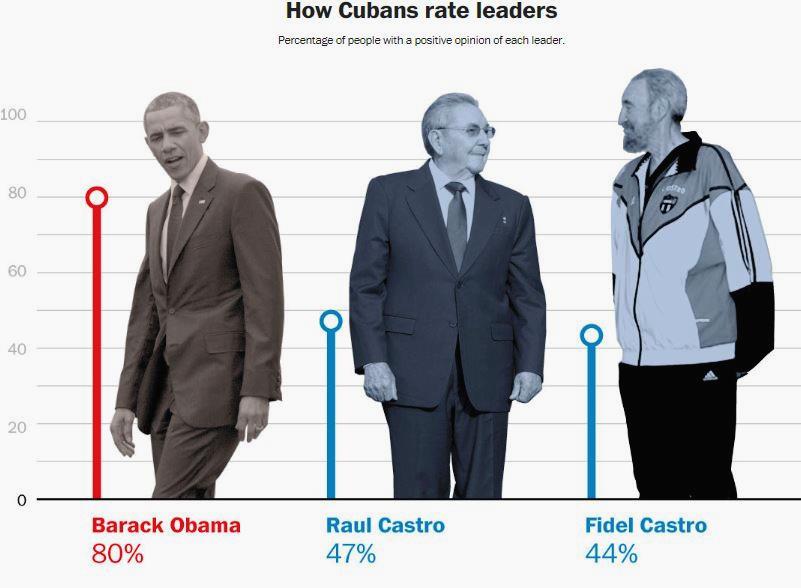

“Peace broke out!” the old teacher was heard to say, on the day that Barack Obama and Raul Castro reported the reestablishment of relations between Cuba and the United States. The phrase captured the symbolism of a moment that had all the connotations of an armistice reached after a long war.

“Peace broke out!” the old teacher was heard to say, on the day that Barack Obama and Raul Castro reported the reestablishment of relations between Cuba and the United States. The phrase captured the symbolism of a moment that had all the connotations of an armistice reached after a long war.

Three months after that December 17th, the soldiers of the finished contest don’t know whether to lay down their arms, offer them to the enemy, or reproach the Government for so many decades of a useless conflagration. Everyone experiences the ceasefire in his or her own way, but the indelible timestamp is already established in the history of the Island. Children born in recent weeks will study the conflict with our neighbor to the north in textbooks, not experience it every day as the center of ideological propaganda. That is a big difference. Even the stars-and-stripes flag has been flying over Havana lately, without the Revolutionary fire that made it burn on the pyre of some anti-imperialist act.

For millions of people in the world, this is a chapter that puts an end to the last vestige of the Cold War, but for Cubans it is a question still unresolved. Reality moves more slowly than the headlines triggered by an agreement between David and Goliath, because the effects of the new diplomatic mood have not yet been noticed on our plates, in our wallets, nor in the expansion of civil liberties.

We live between two speeds, beating on two different wave frequencies. On the one hand, the slow routine of a country stuck in the 20th century, and on the other, the rush that seems disposed to mark the whole process of the giant of the north. The measures approved this last 16 January, which relax the sending of remittances, trips to the island, the collaboration in telecommunications and many other sectors, suggest the idea that the Obama Administration seems willing to continue making offerings to the opposing force. Obliging it to hoist the discrete white flag of material and economic convenience.

The feeling that everything can be accelerated has made some within Cuba reevaluate the price per square foot of their homes, others predict where the first Apple Store will open in Havana, and not a few begin to glimpse the silhouette of a ferry linking the island with Florida. The illusions, however, have not stopped the flow of emigrants. “Why should I wait for the yumas to get here, if I can go and meet them there?” a young man said mischievously, as he waited in line for a family reunification visa outside the United States consulate in the Cuban capital at the end of January.

The fear that the Cuban Adjustment Act, which was passed by the U.S. Congress in 1966 and offers considerable emigration benefits to Cubans, will be repealed has multiplied illegal migration. Those who don’t want to leave are preparing to take advantage of the new scenario.

A few years ago emigration fever led thousands of compatriots to dust off their Spanish ancestors in hopes of obtaining a European Union passport, and now those who have family in the United States sense an advantage in the race for Cuba’s future. From there can come not only the longed-for economic relief, many think, but also the necessary political opening. Lacking a popular rebellion to force changes in the system, Cubans pin their hopes on conditioned transformations from outside. One of the ironies of life in a country whose political discourse has so strongly supported national sovereignty.

Those who have more problems dealing with what happened are those whose lives and energies revolved around the conflict. The most recalcitrant members of the Communist Party feel that Raul Castro has betrayed them. Eighteen months of secret conversations with the adversary is too much time for those stigmatized by a colleague in their workplace because they have a brother living in Miami or because they like American music.

Just outside the United States Interest Section in Havana (SINA), the government has not replaced those ugly black flags that used to fly between the anxious gazes of Cubans and the well-guarded building. No one can even pinpoint the moment in which the billboard boasting, “Gentlemen Imperialists, we are absolutely unafraid of you” was taken down. Even TV programming has a vacuum, now that the presenters don’t have to dedicate long minutes lambasting Obama and the White House.

Miriam, one of the independent journalists who is slammed by government television, wonders if now they are no longer demonizing anyone because of the rapprochement with American diplomats, or in order to cross the feared — but seductive — SINA threshold. Many wonder the same after seeing Cuban officials, like Josefina Vidal, smiling at Roberto Jacobson, U.S. Assistant Secretary of State for the Western Hemisphere.

In a house in the Cerro neighborhood where they have opened a pizza stand, a man in his 50s turned off the radio so he didn’t have to listen to Raul Castro’s speech on that Wednesday. He clicked his tongue angrily and shouted at his wife, “Look out, afterwards we get screwed!” Santiago, as he is called, couldn’t graduate as a doctor because his whole family left in the Mariel Boatlift in 1980 and he was declared “unreliable.” Although, since the mid-nineties he’s back in touch with his exiled siblings, he still feels uncomfortable because now what was previously forbidden is applauded.

Twenty-four hours after that historic announcement, all around the capital’s Fraternity Park it was like an anthill. Old American cars that operate as collective taxis in Havana converged there. The owner of a 1954 Chevrolet pontificated on a corner that now “the prices of these cars are going to go through the roof.” Surely, the man concluded, “The yumas are going to buy this junk like it’s a museum piece.” A country “for sale” waiting for the deep pockets of those who, until yesterday, were rivals.

This feeling that the U.S. will save the island from economic hardships and chronic shortages underpins an illusion clung to by millions of Cubans. We have gone from Yankee go home! to Yankee welcome!

The blacker official propaganda painted the panorama in the U.S., the more it helped to foster interest in that country. Every attempt to provoke rejection of the powerful neighbor brought its share of fascination. Among the youngest citizens this feeling has grown in recent years, supported also by the entry into the country of audiovisual and musical productions that celebrate the American way of life. “Sometimes, to annoy my grandfather, I put on this scarf with the United States flag,” confesses Brandon, a teenager who greets the dawn on weekends sitting on some bench on G Street. All around him, a fauna of emos, rockers, frikis, and even vampire imitators, who gather to talk loud and sing together. For many of them, their dreams seem closer to materializing after the embrace between the White House and the Plaza of the Revolution.

“We have a group of Dota 2 players,” says Brandon about his favorite pastime, a videogame that’s causing a furor in Cuba. He and his colleagues spent months preparing for a national tournament, but after 17 December they have begun to dream big. “The international championship is in Seattle in August, so now maybe we can participate.” Last year, the Chinese team was crowned champion, so the Cuban gamers haven’t lost hope.

The first Netflix user in Cuba was a foreigner, a European diplomat who rushed to get an account on the well-known streaming service, just to know if it was possible. It costs him just $7.99 a month, but the broadband necessary to reproduce video required him to pay the Cuban Telecommunications Company another $380.00 a month for an Internet connection. Now in his mansion he enjoys the most expensive Netflix in the world.

Baseball games with major league teams; famous rock bands coming to the island; Mastercards that work in ATMs all over the country; telecommunications companies that establish direct calls to the US; Colorado farmers willing to invest in the troubles of Cuban peasants; made in USA TV presenters who come to film their shows in the streets of Havana; and attractive models — weighed down by their own scandals – taking selfies with Fidel Castro’s firstborn. Cuba is changing at the speed of a tortoise that flies by clinging to the legs of an eagle.

Despite everything, the Plaza of the Revolution does not want to acknowledge its failure and has surrounded the reestablishment of relations with the United States with an aura of victory. It claims to have won through surviving for more than five decades, but the truth is that it has lost the most important of its battles. It doesn’t matter that the defeat is now masked with cocky phrases and boasts of having everything under control; as a jaded Santiaguan says, “After so much swimming they’ve ended up drowning on the shore.” Seeking that image of control, Raul Castro has not reduced the repression against dissidents, which in February reached the figure of 492 arbitrary arrests. The Castro regime extends a hand to the White House, while keeping its boot pressed on the non-conformists in its own backyard.

However, the disproportion of the negotiating forces between the two governments has been noted, even in popular jokes. “Did you know that the United States and Cuba broke off relations again?” one of the incautious mocked in December. Before an incredulous, “Noooo?!” the jokester responds with a straight face: “Yes, Obama was upset because Raul called him collect.” There is all the material poverty of our nation contained in that phrase.

While no one believes that the Castro regime will end up crushed by McDonald’s and Starbucks, the official propaganda occasionally revives a cardboard anti-imperialism that no longer convinces anyone. Like that in Raul Castro’s bombastic speech at the 3rd CELAC Summit in Costa Rica, in which he made tough demands for the reestablishment of relations with Washington. Pure fanfare. Or like Fidel Castro’s latest message to Nicolas Maduro, offering him support “against the brutal plans of the U.S. Government.” Or like the calls to defend the Revolution, “before the enemy that tries new methods of subversion.”

The truth is that on December 17 — St. Lazarus Day — diplomacy, chance and even the venerated saint of miracles addressed the country’s wounds. We needed a half century of painfully crawling along the asphalt of confrontation on our knees to bring us a little of the balm of understanding. Nothing is resolved yet, and the whole process for the truce is precarious and slow, but on that December 17th the ceasefire arrived for millions of Cubans who had only known the trenches.

*Translator’s note: This is the longer version of this article originally published in El País Semanal.

14ymedio, Cuba’s first independent daily digital news outlet, published directly from the island, is available in Spanish here. Translations of selected articles in English are here.

14ymedio, Cuba’s first independent daily digital news outlet, published directly from the island, is available in Spanish here. Translations of selected articles in English are here.

Dreaming of Major Capital Gains!

Dreaming of Major Capital Gains!

Caracas-based CAF – Development Bank of Latin America

Caracas-based CAF – Development Bank of Latin America