Mario A. González-Corzo* Cuba Transition Project, Institute for Cuban and Cuban-American Studies, University of Miami, Issue 239, March 11, 2015

Washington’s “new course on Cuba” presents a new set of challenges, opportunities and new prospects for the Island’s emerging self-employed workers. There are several reasons for this:

1. Despite existing constraints and limitations, policy contradictions, and the predominance of bureaucratic economic coordination mechanisms and centralized planning, the expansion of self-employment is one of the principal elements of Cuba’s efforts to “update” its economic model.

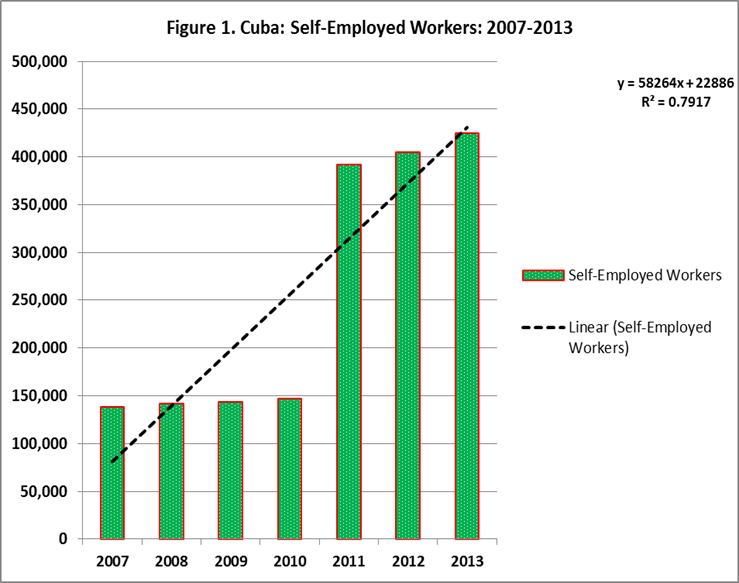

2.The implementation of a series of reform policy changes in Cuba since 2007, and particularly after 2010, have contributed to the rapid expansion of self-employment and its growing share of total employment (Figure 1).

Source: Oficina Nacional de Estadísticas e Información [ONEI], 2014; author’s calculations.

-

While limited openings to allow the expansion of self-employment are not a new phenomenon in the Cuban economy, the number of legally-registered self-employed workers has grown significantly since 2007.

- Self-employment has grown at an even faster rate since 2010, when the Cuban government announced its plan to reduce its bloated State payrolls by 20% and after 2011 when the number of authorized self-employment categories was increased to 201.

- The number of self-employed workers grew 206.6% from 138,400 in 2007 to 424,300 in 2013. By contrast, employment in the State sector fell 10.1% between 2007 and 2013, and employment in cooperatives declined 6.2% during the same period.

- While the State sector accounted for 82.9% of total employment in 2007, this figure fell to 73.7% in 2013. Self-employed workers represented 2.8% of total employment in 2007, but their share of total employment grew to 8.6% in 2013.

- Most self-employed workers in Cuba, however, are presently employed in relatively low-skilled (service-oriented) activities. They also face a wide range of legal prohibitions that limit their ability to grow and achieve economies of scale and their potential contributions to the country’s development and economic growth.

3. Despite facing strict State-imposed controls and limitations, self-employment has contributed to job creation, the provision of goods and services that were insufficiently produced by the State, and increases in the State’s tax revenues; it has also contributed to changes in attitudes, perceptions, and relationships between a growing segment of the Cuban population and the State, leaving a lasting “footprint” on the Cuban economy.

4. Since the limited liberalization of self-employment and the legalization of the U.S. dollar in 1993, self-employed workers have been among the principal recipients of remittances from abroad, particularly from the Cuban community in the United States, directly serving as one of the principal mechanisms to strengthen transnational ties between both countries.

While self-employment expanded significantly (206.6%), and its share of total employment increased notably during the 2007-2013 period, it has grown at a much slower rate, following the initial spurt experienced in 2011. This can be primarily attributed to existing restrictions on the types of self-employment activities that are currently authorized, excessive State regulation and intervention, the inexistence of input markets where self-employed workers and micro-entrepreneurs can obtain essential inputs at competitive prices in Cuban pesos (CUP), onerous taxation, and the remaining ambivalence of the State’s policies and attitudes towards the self-employed.

Cuba’s self-employed workers also have to contend with a dilapidated infrastructure, excessive bureaucratic constraints, insufficient sources of funding (excluding remittances), logistical difficulties do to the existence of primitive (quasi-formal) supply chains, government restrictions regarding the accumulation of capital (or concentration of wealth), and limited property rights. In addition, they lack access to mobile payment platforms, advanced (computerized) accounting and transactions (or sales) recording systems, and modern procurement and purchasing systems.

In terms of market segment concentration, it is worth noting that a notable share of self-employed workers is engaged in tourist-oriented activities such as food services (servicios de gastronomía), lodging or hospitality (alquileres), and transportation. Many of these depend on remittances from abroad as a primary source of working capital, and the majority of their client base consists of tourists and foreign visitors. Primarily catering to a limited (albeit affluent) market segment, rather than to a wider strata of the Cuban population, limits their market share and opportunities for growth and expansion.

Despite facing these challenges and limitations, the number self-employed workers in Cuba continues to expand (albeit at a slower pace in recent years), demonstrating the resilience of the entrepreneurial spirit that has historically characterized a significant portion of the Island’s population.

Given the growing importance of self-employment in the Cuban economy in recent years, the strong transnational linkages between a significant portion of self-employed workers and their friends and relatives in the United States, new U.S. policies towards Cuba are likely to impact this key sector of the Cuban economy in several ways:

- Continued expansion of self-employment activities, including new more value-added categories.

- Improved access to credit and equity capital to finance small-scale private business ventures.

- Opening to foreign investment, including partnerships with Cubans residing abroad.

- Future expansion of firm size, scope, and areas of operations.

- Greater share of total employment and contribution to Gross Domestic Product (GDP), tax payments, and social security system contributions.

- Adoption of modern point of sales (POS) systems, accounting systems, and inventory anagement systems to track sales and report business operations (and thereby improve the State’s ability to collect taxes from microenterprises and self-employed workers).

Despite all the potential (positive) effects of the new US policy approach with regards to self-employment, their real impact “on the front lines” depends on whether or not the Cuban government has the political will to implement deeper reform measures that will reduce the monopoly of the State, while permitting the expansion of the private sector by eliminating the “internal embargo.” On the economic front, this can be accomplished by lifting the internal restrictions, excessive regulations, onerous taxation, and bureaucratic limitations imposed by the State on the self-employed. On the political front, this process would require a radical shift in the State’s perceptions and attitudes towards the self-employed, recognizing Cuba’s emerging entrepreneurial class not only as a source of tax revenue for the State, but as primarily as a an engine of job creation, wealth formation, and the economic growth and development.

_________________________________________________

*Mario A. González-Corzo, Associate Professor, Department of Economics and Business, LEHMAN COLLEGE, City University of New York (CUNY), and is a Research Associate, Institute for Cuban and Cuban-American Studies (ICCAS), University of Miami

The list of jobs that are eligible for self employment seems idiosyncratic (to be charitable). (Has this list been updated)?

The majority are craft or service oriented — not interesting candidates for export. One exception is “computer programmer.” One could imagine Cuban entrepreneurs exporting software and Internet services if authorized by the government.

A quick test could be the inclusion of some Cuban software in the Google Play store or other online software sales sites.