By Arch Ritter

The joint venture between Sherritt International and Cuba is a cooperative masterpiece that generates great benefits for both parties. However, when looked at from the perspective of transportation costs – shipping nickel/cobalt concentrate from Cuba to Fort Saskatchewan Alberta – together with the “Helms-Burton” status of the mine, some questions occur as to its long term viability.

The Moa mine was initially constructed by US interests – the Moa Bay Mining Company and expropriated by the government of Cuba in August, 1960. The US Foreign Claims Settlement Commission valued the company at $88,349,000 at the time of the take-over.

Sherritt’s connection with Cuba began in 1991 with purchases of Cuban nickel concentrate for its Alberta refinery. Sherritt had had insufficient volumes of concentrate for many years and in 1990 a refining contract with INCO expired. In 1994, Sherritt International and the Compania General de Niquel of Cuba established a 50/50 joint venture, which now owns the Moa extraction, processing, and smelting operation, the Alberta refinery and the international marketing enterprise. The President of the company, Ian Delaney, also negotiated agreements with the Cuban Government, permitting Sherritt to enter other sectors of the economy, including electric energy, oil and gas, agriculture, tourism, transportation, communications, and real estate. By 2000, Sherritt International had become a major diversified conglomerate in Cuba.

Sherritt International CEO Ian Delaney and President Raul Castro appreciate a comment.

Sherritt International CEO Ian Delaney and President Raul Castro appreciate a comment.

In this deal, the Cuban Government became and is currently a foreign investor in Canada, as the Compania General de Niquel owns 50% of the nickel refinery, a fact not well known in either Cuba or Canada.

I. The Nickel/Cobalt Operation

The linking of the Moa nickel deposit and part of Cuba’s processing capacity with the Alberta refinery and its access to attractive energy sources was a masterful move and has generated important benefits for Cuba and for Sherritt. Cuba has acquired a market for its nickel concentrate. It acquired access to improved production technologies relative to its older 1950s-vintage US technology and its 1960s-vintage Soviet technology which has generated improvements in productivity, energy efficiency, environmental impacts, and health and safety. The Government of Cuba is now the joint owner of a vertically integrated nickel operation, from extraction through to refining and international marketing. Cuba also has obtained new technologies and managerial skills for oil and gas extraction and utilization, as well as electricity generation.

The Nickel Refinery at Fort Saskatchewan Alberta, jointly owned 50/50 by Sherritt International and the Compania General de Niquel of Cuba.

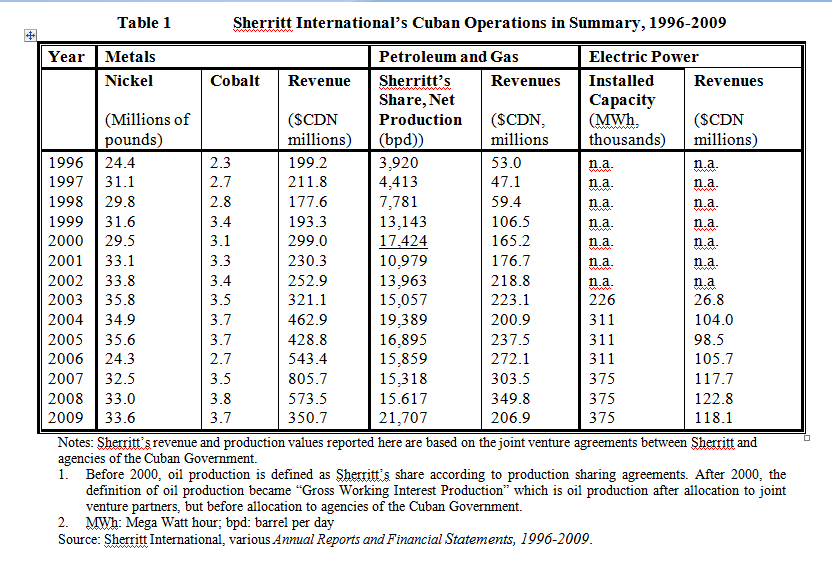

Sherritt is able to utilize more fully its Canadian refinery and to use its base in nickel to enter other sectors in Cuba. Its earnings from its Cuban operations are significant. The joint venture has been able to increase metal production and achieve high net operating earnings, which have been in the area of 40 to 50 percent of the company’s gross revenues for most years, depending on international nickel prices. The following Table presents some information on Sherritt’s Cuban operations, drawn from its Annual Reports.

II. Petroleum, Natural Gas and Electric Power

Sherritt International’s petroleum and natural gas activities also have been successful. New sources of oil and gas have been discovered and extraction rates have increased through enhanced recovery techniques from 1996 to 2000. Natural gas recovery and utilization has also been improved through the construction of two processing plants, a feeder pipeline network, and a 30 Kilometer pipeline to Havana (Sherritt International, Annual Report, 1997, 13).

Sherritt invested CDN $215 million for the construction of two integrated gas processing and electrical generation systems. The natural gas feedstock previously had been flared and wasted. Commissioned in mid-2002, these operations had a combined capacity of 226 megawatts and generated a significant proportion of Cuba’s electricity. At the same time they reduced sulfur emissions, a potential problem especially at the Varadero site, which is adjacent to the hotel zone. By 2007, installed electricity generation capacity had been further increased to 375 mega watts, following an 85 MW expansion that came on stream in early 2006.

In February 1998, Sherritt acquired a 37.5 percent share of Cubacel, the cellular telephone operator in Cuba for $US 38 million, but this has been resold. “Sherritt Green,” a small agricultural branch of the company, entered market gardening, cultivating a variety of vegetables for the tourist market. Sherritt also acquired a 25 percent share of the Las Americas Hotel and golf course in Varadero and a 12.5 percent share of the Melia Habana Hotel, both of which were managed by the Sol Melia enterprise but these also have been divested. By 2010, Sherritt’s Cuban operations were large and growing. Gross revenues reached CDN $1,040 million in 2008.

III. Energy Costs, Transport Costs and Potential Relocation

However, there are two clouds on the horizon. First, Cuban nickel concentrate is transported by ship to the East coast of Canada and then overland to the Alberta refinery. This seems to make sense economically at this time low energy prices in Alberta and the existence of the refinery there compensate for high transportation costs. However, if – or when –transportation costs rise with higher energy prices, and when the existing plant becomes obsolete or simply reaches the end of its useful life, would a different location become more attractive? Low cost energy is also available in Venezuela for example. The Chvez factor is also of relevance. Will a future Cuban post-Raul Government still be enamored of a Chvez or post-Chvez Government in Venezuela? What will be the relative risks of relocating the refinery to another location such as Venezuela?

So far, Cuba is tied to the Canadian location through its 50% joint ownership of the Alberta refinery. Would Sherritt ever accept a transfer of the refinery to Venezuela, if pushed by its Cuban partner? Perhaps in a more distant future that is difficult to foresee. However, Alberta will continue to have competitive energy prices and low risk for a many years to come.

IV. “Helms-Burton” Status of the Mine Properties.

The second possible problem for Sherritt is that the Moa mine and the concentration plant are “Helms-Burton” properties for which there are US claimants. US-Cuba normalization may require Sherritt to negotiate some sort of compensation package for the original US owners. In one scenario, the US claimants would simply take over the Cuba-Sherritt operation in Cuba. But this would not be reasonable because at this time, the refinery for Cuban nickel is in Alberta and it is jointly owned by Cuba. To construct another would be costly. My guess, however, is that Sherritt, the Government of Cuba and the US claimants will negotiate an arrangement that will be reasonable for all parties.

In any case, the claim of US interests on the mine property generates uncertainties and will be problematic at some time in the future. Sherritt International may well be one of the very few economic interests that perhaps could lose from US-Cuban economic and diplomatic normalization.

V. “Nickel Pig iron”

As noted in an earlier entry in this Blog, a technological breakthrough in the production of “Nickel Pig iron” (NPI), a substitute for refined nickel is already having an impact on the nickel market and causing reductions in the price of nickel. This technology will likely put a cap on nickel prices in future a as alternate new supplies enter the market. This will likely reduce Sherrittt and Cuba’s foreign exchange earnings from nickel exports in future, and may halt any expansions in nickel nickel mining for some time to come. (See Bad News for Cuba’s Nickel Industry and Sherritt.)

Thus, while the near-future looks as bright for Sherritt International in Cuba as the last 10 years or so, these three issues raise ambiguities about its medium and longer term future – at least in the nickel sector.

great posting! thanks for link back to our site.