HAVANA October 1, 2013 (AP)

By PETER ORSI Associated Press

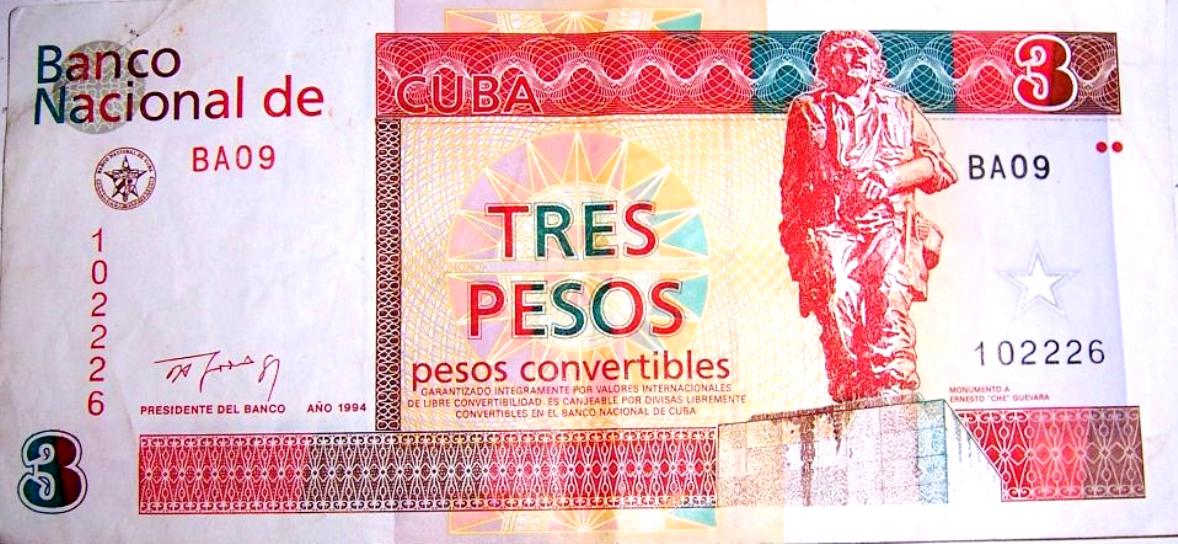

Cuba is the only country in the world that mints two national currencies, a bizarre system that even President Raul Castro acknowledges is hamstringing the island’s socialist economy and must be scrapped. Exactly how to do that is the problem.

Months after Castro made currency unification a centerpiece of a forceful address to parliament, no details have been made public. But a pilot program operating under the radar might hold clues to a way out.

Since the system was created in 1994, most islanders have been paid in national pesos worth 24 to the dollar in exchange houses, while tourists and the Cubans who attend to them receive a much more valuable peso pegged at 1-to-1 with the U.S. greenback. The imbalance means doctors and physicists can make more money driving taxis or renting rooms than they can working in the professions for which they spent years preparing. In his July speech, Castro denounced the setup as having a warping effect on the economy and society in general.Shaking up the dual currency system risks spiking inflation and creating new winners and losers, always dangerous on an island that embraces the goal of egalitarianism. It would also force a change in accounting rules that would eliminate a huge subsidy to state-run enterprises at a time when cash is so short.

Moneda Nacional: Three old pesos = CuP 3.00 = $US o.12

Moneda Nacional: Three old pesos = CuP 3.00 = $US o.12

But there are signs that change is coming, and hints at how the value of the currencies might meet in the middle.

Pavel Vidal, a former Cuban Central Bank economist now at Colombia’s Javeriana University, told The Associated Press that a pilot program is being launched with select state businesses operating at a 10-to-1 exchange rate. The businesses are in key sectors such as sugar, hotels and non-agricultural cooperatives. There has been no mention in the official media, but Vidal said it is happening and it’s a good step. “I think it’s great because the elimination of the double currency must be gradual,” he said.

Even incremental change may be tough to pull off, and requires the unraveling of Byzantine accounting practices that effectively allow state companies to purchase dollars at a fraction of what ordinary Cubans pay for them.

While the rate in exchange houses is 24 pesos to 1 convertible peso, or CUC, the Cuban government treats them as equal in official accounts, meaning state entities are getting them at a 1-to-1 subsidized rate. “Whoever is getting these dollars at one-to-one is doing well, and that’s the official sector,” said Rafael Romeu, former president of the U.S.-based Association for the Study of the Cuban Economy.

Despite reforms under Raul Castro, the state still may be too inefficient to quit the subsidy cold-turkey. “They would be basically confronting their budget constraint in a serious way, and I don’t think they are ready to do that,” Romeu said. “They would have to cut a lot of social services.”

The two pesos have been circulating in parallel since 1994, when the loss of billions in Soviet trade and subsidies forced Cuba to reluctantly open the economy to tourism, while trying to insulate most islanders from its capitalist effects.

The drab local one-peso note bears the visage of independence hero Jose Marti, while the brightly colored CUC bill shows an image of the monument that honors him. Holding it up to the light reveals a magnetic strip with the words “Fatherland or death — we will be victorious,” in Spanish.

Other communist countries have experimented with second, hard currencies aimed at foreigners and business dealings, only to drop them. The Soviet Union tried dual currencies in the 1920s and China in the 1980s and 1990s. For Cuba, the idea seemed simple: Canadian and European travelers would spend hard currency at government CUC shops catering almost exclusively to foreigners, while Cubans would keep living a socialist ideal in the other currency. It hasn’t worked out that way. As authorities pulled back on subsidies that once covered almost all of islanders’ housing and food needs, people grew increasingly dependent on the added CUC income — moonlighting in the tourism industry or receiving remittances from relatives abroad.

The result is the upside-down wage structure where low-skill workers like hotel chamber maids earn more from travelers’ tips than professionals. A 53-year-old doctor recently left the medical profession after 25 years because his $25-a-month salary was putting food on the table for just two days a month. He now helps his mother rent rooms to tourists paying in convertible pesos.

“Professional salaries are in a desperate situation,” he said, speaking on condition of anonymity because doctors generally are not authorized to talk to foreign media. “There’s no motivation, and every day they ask more of you.”

Contrast that with Rigoberto Sanchez Beltran, who pulls in about $70-$100 a month in tips for watching over parked cars at a tourist complex in Havana. Getting by is still tough, but he knows the job gives him a leg up on many of his more-educated neighbors. “You get to know the regulars, and they give you a little more,” he said.

Since 2010, Cuba has seen reforms including the legalization of a real estate market, increased private small businesses and creeping decentralization of state enterprise. In July, Castro declared that the dual currency was “one of the most important obstacles to the progress of the nation.” He did not say, however, how the cash-strapped state would manage to pay white-collar workers more.

Cuban officials have long argued that state salaries are effectively much higher than the often-reported average of $20 a month if you factor in things such as free health care, education and monthly food ration cards. But today just about everyone acknowledges that low pay has been the enemy of efficiency, doing little to inspire hard work. Employees often pilfer supplies to resell or barter, or spend work hours on side projects that bring in CUCs.

At stores that still offer cheaper prices in national pesos, goods from soap to mops sell out quickly, snapped up by hoarders or black marketeers. So finding basics such as cooking oil and eggs often entails a trip to a CUC store.

“It’s totally absurd that you get paid in one currency, but in order to live you need to pay with another,” said Margarita Nieves, 69. “Until they fix that, they can’t keep telling people there’s no productivity.”

Three “Convertible Pesos” or CuC; CuC3.00 = $US 3.00 more or less.