By Emilio Morales and Joseph L. Scarpaci, Miami (The Havana Consulting Group).— Fidel Castro’s government reluctantly accepted remittances from abroad in 1993 when it realized it needed access to hard currency to survive.

It was a devastating ideological blow at the beginning of the so-called ‘Special Period in a Time of Peace’ because it revealed that the Cuban exile community had become a lifeline for the island. Suddenly, U.S. dollars started inundating the island and would never leave. Both the Cuban society and the exile community were startled by this bold move.

The former Cuban leader probably never imagined that the forced opening up to dollars was going to become the most efficient driver in the economy over the last 20 years. Not a single Cuban economist foresaw that outcome. Today, remittances reach 62% of Cuban households, sustain about 90% of the retail market, and provide tens of thousands of jobs.

Money sent from overseas far exceeds the value of the once powerful sugar industry which, in 1993, began a huge decline from which it has not recovered. Remittances in 2013 surpass net profits from tourism, nickel, and medical products manufactured by the Cuban biotech industry.

Table 1. Remittances versus Other Sources of Hard Currency in Cuba, 2012 (in millions of US dollars)

|

No. |

Source |

2012 |

|

1 |

Remittances received in cash |

$2,605.12 |

|

2 |

In-kind remittances |

$2,500.00 |

|

3 |

Total remittances |

$5,105.12 |

|

4 |

Tourism revenues |

$2,613.30 |

|

5 |

Nickel exports |

$1,413.00 |

|

6 |

Pharmaceutical exports |

$500.00 |

|

7 |

Sugar exports |

$391.30 |

Data sources: Calculated by The Havana Consulting Group, based on their data and open-source statistics published by the Oficina Nacional de Estadísticas e Información (ONEI), Havana.

The table above shows that remittances ($5.1 billion) outstrip the leading four sectors of the Cuban economy combined ($4.9 billion). Moreover, the figures for items 4 through 7 do not take into account expenses incurred in generating those gross revenues (i.e., costs of processing sugar, manufacturing drugs, food imports, etc.). Sending remittances does not cost the Cuban government money, but it circulates throughout he economy and supports most Cubans in some way.

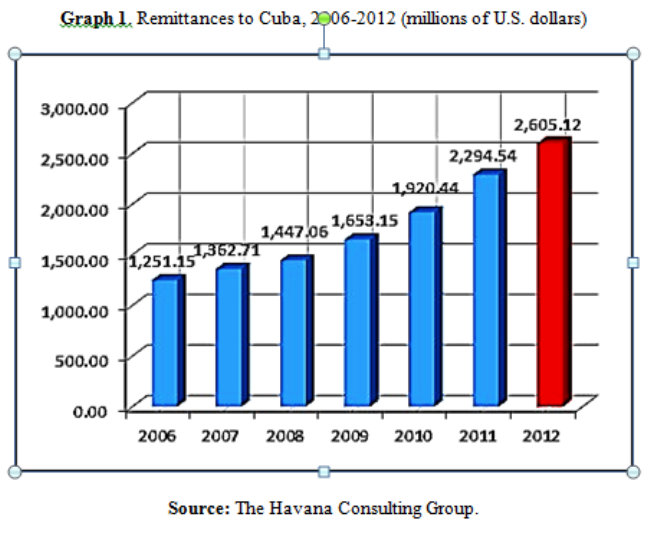

White House Policies Trigger Growth in Remittances

Barack Obama’s arrival in the White House has directly influenced the increase in money being sent to Cuba. In the past four years, $1 billion USD of remittances have infused the Cuban economy.

Cash remittances in 2012 reached a record $2.61 billion USD; a 13.5% increase over 2011.

In other words, cash remittances outweigh government salaries by 3 to 1. The current monthly mean salary according to ONEI (the official government statistics agency) is 445 Cuban pesos, or the equivalent of just under $19 USD. Today, the economically active work force is 5.01 million workers, of which about 80% (4.08 million) draw state paychecks, whereas the balance is self-employed, agricultural, or cooperative workers.

If we use the official exchange rates that one Cuban convertible peso (CUC) equals 24 pesos (CUP) or one US dollar, the annual payout for state workers is three times less than the volume of money that Cuban émigrés send to family back home. Include in-kind remittance contributions (gifts, appliances, clothing, etc., brought to Cuba during visits), and the ratio leaps to 5.5 to 1.

Behind this growth in sending money to Cuba is the opening up of travel to Cuba as well as eliminating restrictions on sending money there. In 2012, just over a half a million Cubans residing abroad visited Cuba, making them the second largest tourist group in the island’s market; only Canadians (1.1 million visits) surpass them.

Behind this growth in sending money to Cuba is the opening up of travel to Cuba as well as eliminating restrictions on sending money there. In 2012, just over a half a million Cubans residing abroad visited Cuba, making them the second largest tourist group in the island’s market; only Canadians (1.1 million visits) surpass them.

Out-migration from Cuba –about 47,000 annually on average over the past decade or nearly a half million émigrés—is also a contributing factor because those who have most recently left the island are the ones most inclined to send money back home. That was not the pattern with the original exile community in the 1960s; sending dollars to the island was forbidden back then.

We also need to acknowledge that several reforms introduced by the Cuban government in the past three years have encouraged remittances. This cash infusion helps to start home restaurants (paladares), B&Bs, car rentals, and more recently the buying and selling of private cars and real-estate. These businesses are aided by the 1.6 million cell phones in use today –available to the general public only since 2007—of which 70% are paid for by Cubans living off the island.

Never at a loss to encourage remittances, the Cuban government announced just last month the opening of 118 Internet stations that charge very high hourly rates. The new cyber cafés will initially cluster in the tourist poles across the island and the provincial-capital cities.

At the present, then, the role the Cuban diaspora plays in developing the island’s economy has never been greater, despite the restrictions on how and where money can be invested. However, the short term is unlikely to witness a greater influx of capital beyond the diaspora’s giving. Witness the failures in recent offshore gas and oil oil drillings that have come up ‘dry’ and the political and economic crisis in post-Chávez Venezuela is mired. This may create a broader space for the exiles to have a more direct hand in rebuilding the country.

Like it or not, Cuban exiles carry economic clout on the island. They have a lot of skin in the game; some of it is economic, and a lot of it is love of family. Their role in shaping the lives of many will be transformative in years to come, and on both shorelines that straddle the Florida Straits.

Last Updated (Tuesday, 11 June 2013 04:20)